Smartphone 2Q25: boring boring

For Semiconductor firms (QCOM, MTK, TSM), chips ASP increases 10-15% at each generation, not that bad. For hardware vendors (Apple, Samsung, Xiaomi), it's worse.

IDC and Counterpoint released their 2Q25 smartphone estimates. Smartphone units increased 1-2% YoY. Best performer: Samsung +8% YoY, but this didn’t help 2Q operating profits. Vivo +5%, Apple +2%.

The smartphone market is desperately flat – or in slow decline. Smartphone is 76% of revenues for Qualcomm, 57% for Mediatek, 50% for Apple and Xiaomi, 35% for Samsung, 31% for TSMC. Problem?

For the Semiconductor firms (QCOM, MTK, TSM), chips ASP increases 10-15% at each generation, between node migration (N3, N2) and increasing AI functionalities. For hardware vendors (Apple, Samsung, Xiaomi), it’s worse.

2Q25 smartphone data

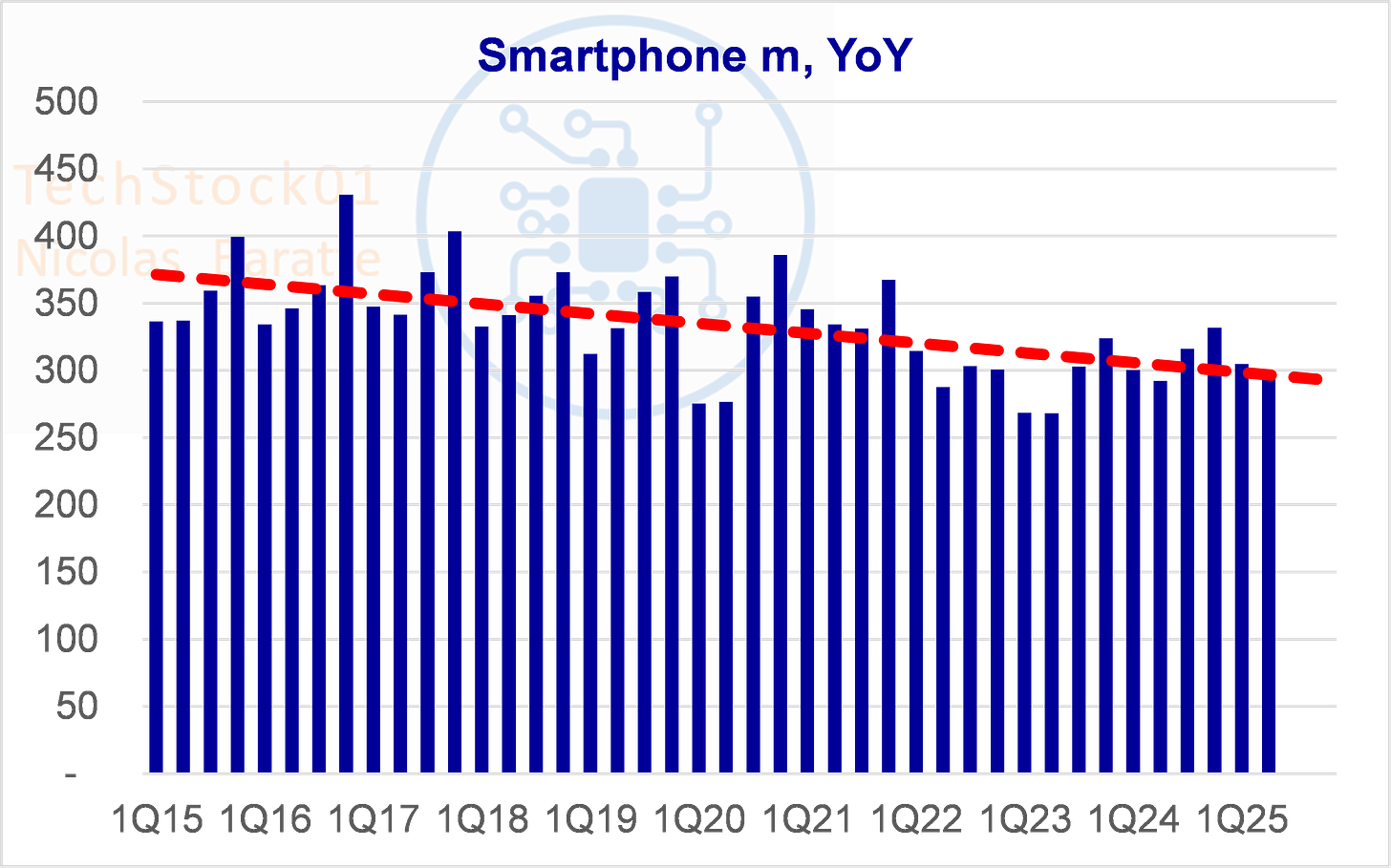

In a chart format, you can see:

the 2020-21 Covid boom (consumers stuck at home buying more computers and smartphones),

the 2022-23 post Covid crash (consumers buy fewer goods, but more services, ie go to the beach),

and now the normalization period: demand is flat

But if you put a linear regression line on quarterly data, it looks a bit worse: smartphone sales are steadily declining. The primary reason for this is: this has happened to all categories of consumer electronics, from notebook, TV, smartphone, tablets, etc etc. In the initial years, products improve quickly (small screen to big screen, 4G to 5G, bad camera quality to good quality, etc) which triggers a short replacement cycle of 2-3 years. But over time, there incremental improvements become smaller and consumers are less motivated to buy the latest smartphone. This year’s new model looks very much like last year’s version. The replacement cycle extends to 4 years… 5 years… longer…

Comments on 2Q25

Counterpoint

Smartphone Shipments Up 2% YoY in Q2 2025. 2nd consecutive quarter of growth, largely driven by North America, Japan and Europe.

Entry-level and budget 5G devices saw growing traction in emerging markets, while premium demand remained steady in mature markets

Samsung retained the top position and was also the fastest-growing among the top five OEMs, with 8% YoY growth driven by regional resilience and strategic product launches, such as a mid-tier A-series refresh.

Apple sustained its growth trajectory in Q2 2025, registering a 4% YoY increase driven by robust performance across North America, India and Japan.

IDC

Smartphone Market Grows 1.0% in Q2 2025, Despite Global Uncertainty and Weak Demand in China

Economic uncertainty tends to compress demand at the lower end of the market, where price sensitivity is highest. As a result, low-end Android is witnessing a crunch weighing down overall market growth

Lower than expected performance in China also contributed to the flat global growth. China declined in Q2 as subsidies failed to stimulate demand.

Samsung achieved strong growth in the quarter driven by the sales of its new Galaxy A36 and A56 products. These new products introduce AI-enabled features to mid-range devices.

Full year data

My forecasts below. I mean who cares +- 2% per year does not lead to any investment conclusion.

Stocks valuation

Apple: my opinion: very expensive given hardware slow growth, AI mess up, the only justification for high PE is really stock buy backs.

Samsung: Smartphone is not relevant, Memory and HBM are the potential drivers, up or down.

Xiaomi: Smartphone is not relevant, EV dream.

Mediatek: high valuations based on a potential AI chip new market in 2026 or 2027. Lots of rumors of Mediatek designing a Google TPU. Management doesn’t quantify but gives bullish comments. Room for disappointment on high expectations.

Qualcomm: low valuations as Smartphone (chips and licensing) are 76% of revenues and diversification (computers, automotive, ioT) is slow.

TSMC: Smartphone is not relevant, AI growing at 45% cagr