2/3rd of Semiconductor revenues are slowing down into 2H24 (AI, PC, Server, Smartphone)

The recovering segments (Industrial, Networking, Auto) are too small to change the overall trajectory

The Semi sector is still expensive – valuations charts are borderline scary

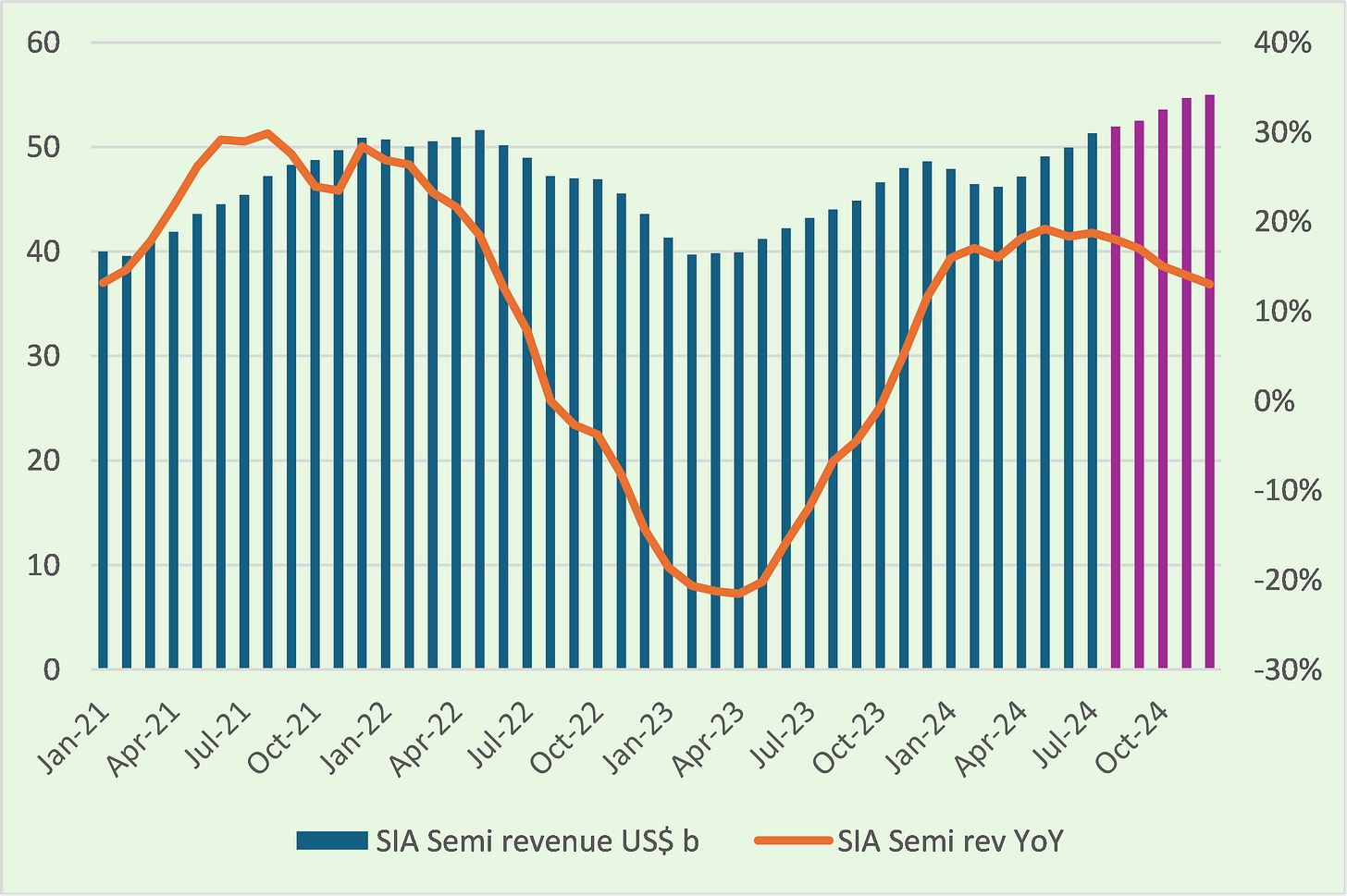

The first post I published on Substack (here, 17 July) was on peaking Semiconductor revenue growth and how that implies that stocks are peaking as well. The latest Semi revenue datapoint (from SIA / WSTS) confirm that growth is at peak. Guidance from firms suggest the same. And now we have seen stocks / Tech indexes starting to correct.

Prelim:

This post is about growth. AI is slowing means the year-on-year YoY revenue growth of AI is slowing. It does not mean that AI revenues are declining. We want to assess stock valuations (ie expectations of growth) versus the actual growth.

Tech indexes corrections. The peak was in mid-July (when I wrote about stretched valuations here).

Why Semiconductor industry revenues matter? Because they are 90%+ correlated with stock prices / Big Indexes SOX, NASDAQ, TWII.

What’s the balance of AI revenue growth slowing down versus the rest? Problem is that PC, Server, Smartphone will also slowdown in 2H24.

Let’s cut the Semi market into 2 chunks:

Memory (DRAM / HBM, NAND):

declined by -60% from 2021 to 2023

increasing sharply by ~+80% in 2024 because AI means HBM which is sucking up a lot of DRAM capacity.

Logic:

flat revenue in 2023 because AI revenues increased 3x

increasing by ~12% in 2024 because AI revenues are increasing by 2x and Smartphone, PC, Server revenues are increasing in 1H24 after a steep decline in 2023 (inventory correction)

So full-year 2024 looks good, but there is a downward inflection from 2Q24. We have a pretty clear picture (below) of the slowdown in AI, PC, Server, Smartphone revenue growth from 2Q24, continuing into 2H24.

Why is it clear? Guidance from Broadcom and Nvidia on 3Q24 and full year is clear. The shape of inventory de-stocking, re-stocking for PC, Server, Smartphone is equally clear (chart below).

Overall, how bad is it? AI, PC, Server, Smartphone altogether represent 2/3rd of total Semiconductor revenues.

What can improve? Smaller segments:

Automotive and Industrial are declining but should grow again by end-2024

Networking is declining but should grow again by end-2024

The chart below shows my estimates (in purple) of Semi revenues. It doesn’t look dramatic with ~12% revenue growth by end-2024. Consensus Semiconductor forecasts, incl IDC, SIA, look right: ~17% revenue growth in 2024, ~12% in 2025.

So we have an outlook problem here: 12% growth in 2H24. 12% growth in 2025.

Semi industry revenue projections US$bn, YoY:

Aggregate valuations of Semiconductors are still high.

The charts below aren’t the Philly SOX but a broader version that includes more Asian stocks, Mediatek, Samsung, SK Hynix, Tokyo Electron, etc. Self explanatory, I guess: valuations are still very high.

AI stocks Broadcom, Nvidia, SK Hynix, TSMC will correct, either because expectations are high, or valuations high, or technical elements (rotation to financials) or macro views (Feds rate cuts, US$ weakening). We should sell some now and buy back later.

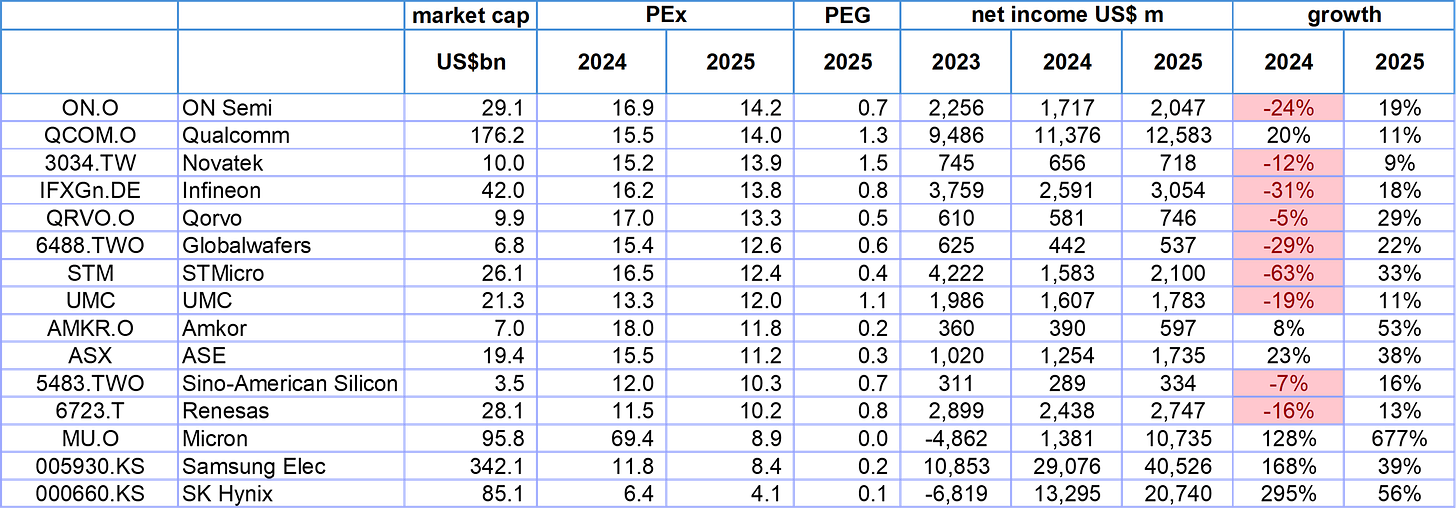

The bottoming out of Networking, Industrial in 2H24 and Auto in 1H25 makes a few cheap stocks look attractive: Infineon, Renesas, ST Micro (valuations table below).

Top 15 most expensive stocks on 2025 PEx

Bottom 15 cheapest stocks on 2025 PEx