Semi revenue from SIA

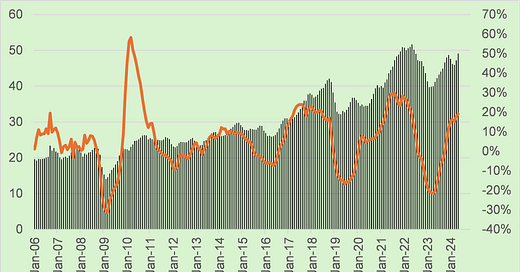

Every month SIA (Semi Industry Association) and WSTS (World Semiconductor Trade Statistics) publish global semi revenues. Chart below, reported up to May 2024.

We’re at 20% YoY growth and the growth momentum is slowing or plateauing. Since the bottom of Semi revenues was in 1Q23 at -20% YoY, I think we can reasonably conclude that we’re past the base effect and Semi revenue growth looks like it is going to peak at 20-22% YoY in the next few months.

Which implies that Stocks are near peak as well

1. As you can see in Chart above, the peak is usually higher than the previous trough – in 2010, 2017, 2021. But not this time probably. This implies that beyond

a) cyclical recovery b) the exciting new AI stuff (AVGO, MRVL, NVDA), end-demand is actually not great (mild recovery / stabilization for PC, smartphone; decline for x86 server).

2. There is a very strong correlation between Semi revenue growth and Tech / Semi stock index, on YoY basis. Charts below, YoY change in Semi revenues and in stock index. SOX, NASDAQ and Taiwan (TWII).

You can notice in Charts below that stock index peak / trough 2-3 months before Semi sales. I hate to emphasize the risks but a peak in Semi growth in August implies that stocks’ growth has reached its 2nd derivative. I think this is pretty clear in the SOX and NASDAQ charts below.

WSTS 2024 revenue forecasts implies peak growth in next 3 months

Finally, WSTS published a month ago its 2024 forecast, pasted below at the end. Since I’ve looked at this for a long time and have forecast the Semi market myself, a word of caution: WSTS is not better at forecasting than sell-side analysts. Different bias, same problems.

Nevertheless, WSTS says Semi end-demand / market value will increase by 16% in 2024 and 12.5% in 2025. The 2024 forecast US$ 611bn or +16% YoY is interesting compared the 1st Chart above as it implies:

In Chart above, numbers up to May-24 are reported by SIA. From June-24, they’re mine designed to have a smooth YoY curve and suggest that peak growth will be reached in… June – August 2024 which for stocks means now.

Upside risks?

Have a look at WSTS forecasts below, the last Chart. WSTS forecasts that (in $ value in 2024):

Discreet is declining

Opto-Electro is declining

Sensor is declining

Analog is declining

which implies that demand from Auto, Automation, Industrial, etc is not great. This will improve in 2025 as per WSTS, which is based I guess, on a view on inflation & rates declining.

All the growth in 2024 comes from:

Memory. Double squeeze between 1) less supply (Capex low, production time up on migrations and HBM, utilization cuts) and 2) demand increase from NVDA / HBM, which sucks up a lot more capacity than server DRAM.

Logic. Within this, obviously NVDA growing at ~250% YoY, followed by the smartphone segment probably growing at ~12% YoY (volume +6% * ASP +6%) but PC should be flat and x86 server declining.

IF (this is an hypothetical IF) we assume that Memory and NVDA are reaching peak growth in June-Sept-24, then we need a broad recovery in everything else to kick in.

WSTS Semiconductor Market Forecast Spring 2024

https://www.wsts.org/76/Recent-News-Release

The World Semiconductor Trade Statistics (WSTS) has released its latest forecast for the global semiconductor market, anticipating robust growth in 2024 and 2025.

2024 Forecast: Strong Recovery Expected

WSTS has adjusted its Spring 2024 forecast upwards, projecting a 16.0 percent growth in the global semiconductor market compared to the previous year. The updated market valuation for 2024 is estimated at US$611 billion. This revision reflects stronger performance in the last two quarters, particularly in computing end-markets.

For 2024, mainly two Integrated Circuit categories are anticipated to drive the growth for the year with double digit increase, Logic with 10.7 percent and Memory with 76.8 percent. Conversely, other categories such as Discrete, Optoelectronics, Sensors, and Analog Semiconductors are expected to experience single-digit declines.

2025 Outlook: Continued Solid Growth

Looking ahead to 2025, WSTS forecasts a 12.5 percent growth in the global semiconductor market, reaching an estimated valuation of US$687 billion. This growth is expected to be driven primarily by the Memory and Logic sectors, which are on track to soar to over US$200 billion in 2025 each, representing an upward trend of over 25 percent for Memory and over 10 percent for Logic from the previous year. All other segments are anticipated to record single-digit growth rates.

In 2025, all regions are poised for continued expansion. The Americas and Asia Pacific are expected to maintain their double-digit growth on a year-over-year basis.

WSTS Forecast Summary

My next post will be on valuations.