ASML downgrades, Semi Production Equipment demand

The stock is getting cheaper, but lacks catalysts for another 2-3 quarters

ASML has been underperforming for 18 months. Recent downgrades are a delayed recognition of reality. ASML’s management goals for 2030 (10% revenue growth Cagr) are ok (plausible) but growth is slowing fast in 2H25 and likely 1H26.

Growth should re-accelerate in 2H26 as the impact of China lower spending, Mature node lower spending, multiple delays or cuts (Intel, Samsung) is fading away.

The stock is getting cheaper, but lacks catalysts for another 2-3 quarters. Trading at 25x forward PEx, that’s reasonable given the firm’s intrinsic qualities.

ASML downgrades, the stock is a big underperformer

You might have noticed several ASML downgrades (Jefferies, Barclays, seeking-alpha, a few more). Some downgrades reiterated old news: restrictions on DUV/EUV to China, China spending declining, NAND capex flat at best, Intel lower capex, Samsung foundry stuck. We know all that. For some time already. In similar reiterations, the bullish analysts’ main 2 arguments are 1) AI growth and 2) ASML is a monopoly. Indeed that’s true, but there’s nothing new here and it is not enough if all the negative arguments are true.

Overall, sell-side consensus is positive (charts from LSEG Data & Analytics, formerly Refinitiv and I/B/E/S, aka Thomson Reuters):

But the stock price has been going sideways to nowhere for 1 year.

Or worse. If you’d bough and held the stock since May 2023, you’ve made zero profits.

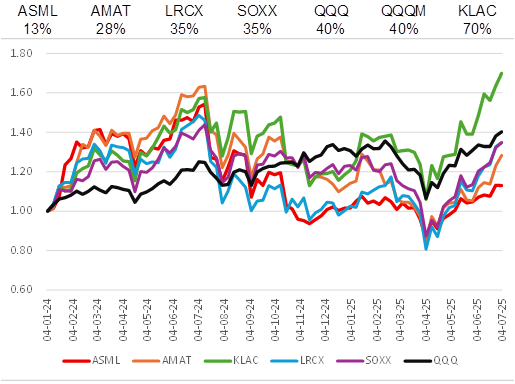

And the even worse thing is that ASML has underperformed everything: its peers (AMAT, KLA, LAM), and Tech indexes (SOX, QQQ). This chart is from 5 Jan 24 to 4 July 25.

So what’s the problem(s) here?

Management provides lofty “indications” and then disappoints

You can refer to my post on ASML Nov 2024 investor conference: ASML Investor Day: Oops They Did It Again. Different Story, Same 2030 Targets. Management provides big “indication” (don’t call it a guidance legally) on 2030 revenues and margins, based on a “story” that keeps changing.

That changing story includes high expectations on High NA EUV adoption, and then the CEO has to deflate these expectations and of course that creates a lot of negative media news. The whole drama is here.

In essence, you can call this a “not smart communication policy”. Really not smart. Why does management keep doing this? The cynics will say “stock price” or “stock option”. I think it is “ego”.

The crux of the problem imo is still what I wrote here in May 2025: great tech upgrades but expectations are still inflated. Inflated expectations for 3 big reasons:

Industry’s expectations are still too high

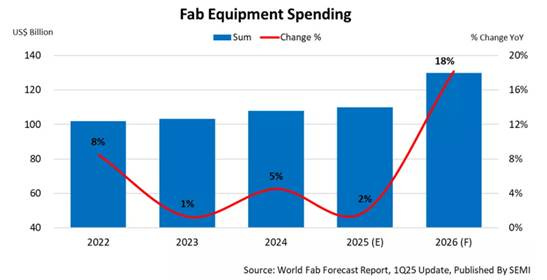

The industry’s official voice, ie SEMI provides a very rosy outlook. Never mind that SEMI projected 2025 growth at 18% one year prior, then revised down to 2% and the magical 18% was pushed out to 2026. It is difficult to track Fab constructions; most companies don’t give guidance for 2025-26 Capex; so Consensus will stick to the “industry’s official view”.

ASML’s own 2030 revenue outlook

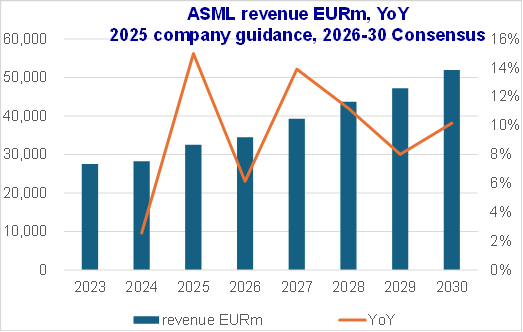

ASML CEO says 2030 revenue targets is EUR 44-60bn. Midpoint EUR 52bn. As a result… of course Consensus is hugging onto that, forecasting this:

You can say that it is reasonable. Revenue growth Cagr from 2025 to 2030 is 10%. Only 10%. When everybody is telling you that the Semi industry will grow at ~8% Cagr to 2030 – or more precisely will reach US$1 trillion by 2030. That’s an overwhelming industry consensus: McKinsey, PwC, SEMI, Yole. I actually think that this will happen..

But that doesn’t add up with 2025 guidance

Why is a 10 Cagr to 2030 a problem? Because 2025 revenue guidance is between €30 billion and €35 billion, with a gross margin between 51% and 53%.

We know 1Q25 (reported)

We have revenue guidance for 2Q25

And we have revenue guidance for 2025. So it’s not too hard to derive these charts and conclude that growth is decelerating to zero by 4Q25.

2026 won’t be great either, at least 1H26

Let’s assume that Consensus is correct on 2026: EUR 34.5bn revenue +6% YoY. This means that 2026 is a sub-par growth year, less than the 10% Cagr to 2030.

Then, if we look at the quarters, I think very likely that growth remains very low, essentially zero, in 1H26.

Why is growth slowing this much?

First, we’re suffering from optical illusion: the growth acceleration of 2024 to 1Q25 was a base effect.

Second, here are the negatives of 2025-1H26:

China spending is slowing rapidly, most notably the Memory spending

Mature Logic is slowing or delayed most everywhere after over-expansion over past 3 years (ADI, Infineon, STMicro, Texas Instr)

Advanced Logic: Intel has cut down Capex, Samsung is delaying its Texas Fab,

NAND Capex is not recovering.

Third, the growth area are only:

TSMC

HBM Micron, Samsung, SK Hynix

Advanced Packaging (all of the above, ASE, Amkor)

Why the improvement in 2H26 will come from:

The base effect of ~4 quarters at zero growth

The impact of China’s lower spending will fade

Most likely, Mature Logic demand (Auto, industrial) will finally bottom out after a very long down cycle (Automotive & Industrial Semiconductors: Is It the Bottom, Finally? Time to Buy?)

AI-related spending will continue (TSMC, HBM)

ASML Consensus forecast, Valuations

I own ASML stock. I am not giving investment advice, this is a Tech blog.