Semiconductor Production Equipment (SPE) part 1: great tech upgrades but expectations are still inflated

Part 2 tomorrow: stocks

Growth expectations have come down, 2025 now expected flat YoY. SPE firms coming to terms with 1) China, Auto & Industrial Capex declining 2) Intel inflated Capex is deflating 3) capacity add only from HBM and AI

The big structural positives continue (HBM, GAA, BSPD, High NA). They all mean higher Capex intensity. It will cost a lot more to build 1k wafer fabrication capacity: from 3nm to 14A, Capex doubles. Wafer price doubles.

Hence the risk is to over-estimate demand: who can afford chips 2x more expensive? The answer is: chips that generate revenue or lower costs, ie chips that run applications in Data Centers – and most likely only these.

This is Part 1, about end-demand and identifying risks to inflated expectations. I explain the reasons why expectations for 2026 are still too high. And Consensus is even higher. We got to look at that before looking at stocks.

Part 2: tomorrow. Applied Materials reports tonight and I’ll compile industry’s revenues, guidance, valuations, etc tomorrow to derive reasonable stock implications. Stay tuned folks.

Definitions and good background readings

Semiconductor Production Equipment (SPE) includes 4 components:

Wafer Fab Equipment (WFE): machines that make chips on wafers

Testing: testing if the chips are good or bad

Packaging, advanced packaging, back-end

services, maintenance, upgrades

SPE companies are very good at using the good-looking number or mixing up the sum and the parts.

Terminology:

SPE Equipment vendors linked to higher Capex intensity: AMAT, ASML, KLA, LAM, Lasertec, Screen, Tokyo Electron

EUV chip makers: Intel, Samsung, TSMC

HBM Memory makers: Micron, Samsung, SK Hynix

Chinese SPE vendors gaining share in Legacy market: AMEC, Naura

The industry often confuses unit cost and quantity

Back in 2019-22, the Automotive Semi industry (ex. Infineon, NXP, STMicro, Texas Instruments) was uber optimistic as several great “structural” good things were kicking in:

An Electric vehicle (EV) needs 2x or 3x more semiconductors than an Internal Combustion Engine (ICE) car

Automobile automation and security was increasing quickly (ADAS level 2-3)

EV growth was amplified by charging infrastructure and higher density power components (Silicon Carbide)

This lead to most firms increasing capacity (Onsemi, STMicro, Texas Instruments) or their suppliers (GFS, UMC).

But then the “western” Auto Semi suppliers were very wrong on 4 points:

Automobile volumes declined, not increased (inflation, shift in consumer spending)

EV adoption was much slower than expected (expected Gvt subsidies disappointed)

Their core “western” car-maker customers are lagging behind Chinese car makers and catching up very slowly

Chinese competitors were often dismissed as legacy vendors, legacy indeed but gaining share

That’s why I titled this confusing unit cost and quantity: the cost will go up, but units maybe not. I see a similar problem for Semiconductor Production Equipment (SPE) vendors today.

For the SPE vendors, there are several great “structural” good things ahead:

Leading Edge Logic manufacturing going to Gate All Around and Back Side Power Delivery will need more capex per wafer (from 2025)

High N.A. EUV will push capex higher still (after 2027)

Legacy Logic: China always need more capacity

DRAM: HBM, EUV litho, and (after 2027) 4F2, 3D DRAM

NAND: moving from 2xx layers to 3xx layers

Big downward revision

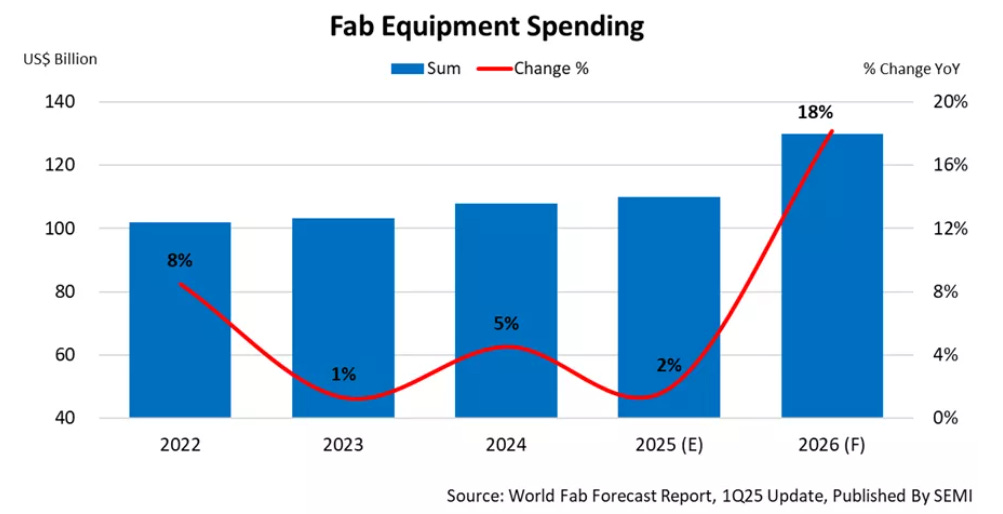

2025 SPE growth has been revised down steadily. 2025 Wafer Fab Equipment (WFE) was supposed to increase by 18% and now its 2%.

in December 2023, SEMI was forecasting for Wafer Fab Equipment (WFE) that

2024 “projected to grow at a modest 3%”

2025 “18% expansion in 2025 is expected as new fab projects, capacity expansion and technology migrations”

in March 2025, SEMI is now forecasting:

2024 +5%

2025 +2% if you listen to Mar-25 conf calls, literally all SPE firms mention that 2025 WFE Capex is flat.

2026 +18% the fun thing, or scary thing, about 18% growth in 2026 is that it looks like pushing the can down the road. That reflects an industry that is not thinking about end-demand. It is just thinking about Capex per unit, not the number of units.

Why was 2025 revised down from +18% to +2%?

Intel capex was cut down sharply, and I am afraid that SPE vendors are still double counting Intel and TSMC (ie part of TSMC Capex is for Intel, Capex that Intel will not spent)

China Logic Capex (SMIC, Hua Hong) is not increasing any more

Auto & Industrial Capex is cut down (ie Auto disappointment that I mention above) and won’t return before 2027-28

China Memory Capex is declining (YMTC, CXMT have enough capacity for a couple of years, complicated dynamics of share gains depressing prices / margins)

Korea NAND Capex on tech upgrades but wafer volume is declining

Why on earth do we believe in 18% growth in 2026?

SEMI says: “Fab equipment spending is projected to rise by 18%, driven not only by demand in the high-performance computing (HPC) and memory sectors to support data center expansions, but also by the increasing integration of artificial intelligence (AI), which is driving up the silicon content required for edge devices”

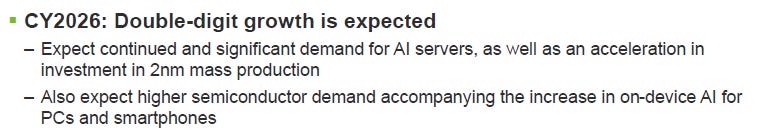

Tokyo Electron (fig. below) has a similar view:

I see 3 problems here

2nm, followed by 18A, 14A will happen, it is happening. GAA and BSPD is happening. Capex intensity is increasing. As a result, wafers are very expensive: what’s the addressable market of a US$35k wafer? Are we sure that Smartphones and Computers need that kind of performance and can absorb that cost?

I am pretty sure that demand below 2nm, or from 18A will be limited to High Performance Computing only – very little consumer electronics. Maybe only AI.

If Capex expectations include AI in Smartphone or PC, that’s dangerous

AI in Smartphone is already 40% done (40% penetration) and Consumers want it. It is 30% done in PC and users don’t care much (CoPilot and GPT run in the Cloud, not in your PC). See here, here, here. The point is that AI in Devices has already happened and has not triggered higher wafer demand, nor unit growth.

If Capex expectations include unit growth for Smartphone or PC, that’s dangerous.

Some things can take a lot longer than expected. Bunch of people got excited when Intel got its first High NA EUV machine in April 2024 and made some typical Intel self-glorifying announcements (here, here, here). And now we have ASML CEO admitting that High NA EUV in production won’t happen before 2028 (refer to 16 Apr 2025 conference call for 1Q25, I can send you the transcript if you ask). Is this funny? Intel said in Feb 2025 that “new ASML machines are in production, with positive results” and then TSMC says best case is 2028 for 14A and ASML COE confirms 2028. Here you go, from Mr. Christophe Fouquet ASML Holding President & Chief Executive Officer:

“high-NA systems… as we have described before, there are three phases of technology insertion:

We are currently in Phase 1, where our customers take a system into their R&D facility and work with us to understand the value and capability of high-NA for their next node

In Phase 2, which we expect to take place in 2026, 2027, customer will start running the system on one, two layers to test its readiness for the new manufacturing

In Phase 3 when customers design in high-NA on their most critical layers in their most advanced nodes and run in manufacturers” .. “and then they will use it fully for any future node in high-volume manufacturing. We have said this will come mostly '27, '28. It can seem a bit long.”

Here is the disconnect

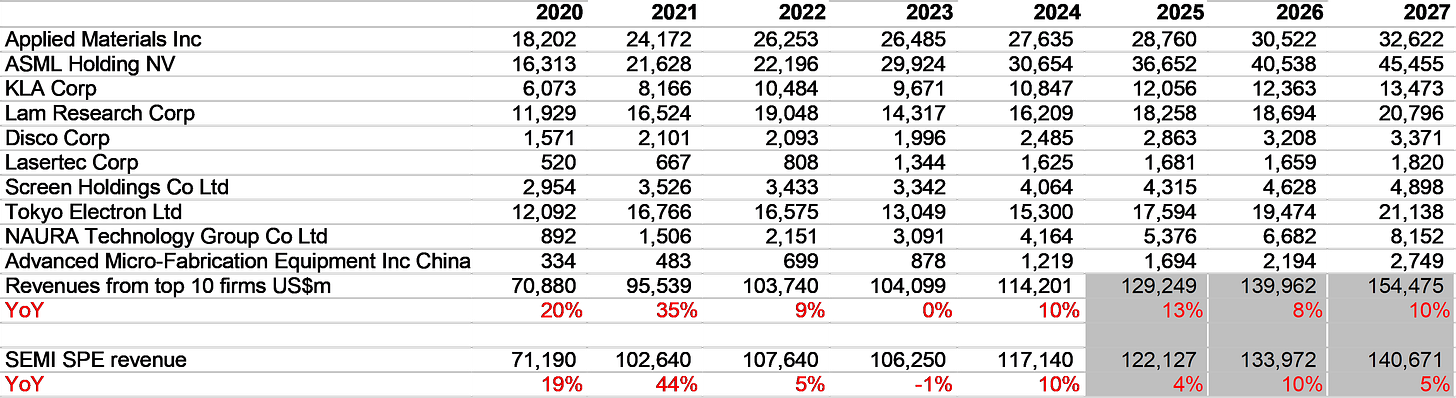

In the table below, I show total SPE spending. That includes Wafer Fab Equipment (the chart above) and also back-end, advanced packaging, testing. So the numbers or growth aren’t the same as above, but close. I compare that to the top-10 firms revenues, which include wafer fab, back end, testing and services and maintenance so it’s not the same, but close. What matters is order of magnitudes.

SEMI estimates for 2026 are optimistic and high, as explained above

Sell-side Consensus on stocks is even higher. That’s where the risk is.

Tomorrow you will get:

What the top firms said in Mar-25 earnings release, waiting for AMAT tomorrow

Expectations and Valuations: what looks attractive, or not