What are the arguments in favor and against an AI bubble?

AI today is like Cloud Computing in 2014

Review of the conventional arguments (Bloomberg article): the timing gap between Capex and Revenue is the real issue.

Review of history of Tech Bubbles (Krugman): not clear if AI is a bubble now, it could keep going for years, but if it bursts it will be worse than 1999-2003.

The best comp for AI is Cloud Computing. Both enable new types of data analytics and new applications. Stuff that couldn’t be done before. Both are platforms on top of which new firms will build new business models. AI can be an amplified version of Cloud Computing.

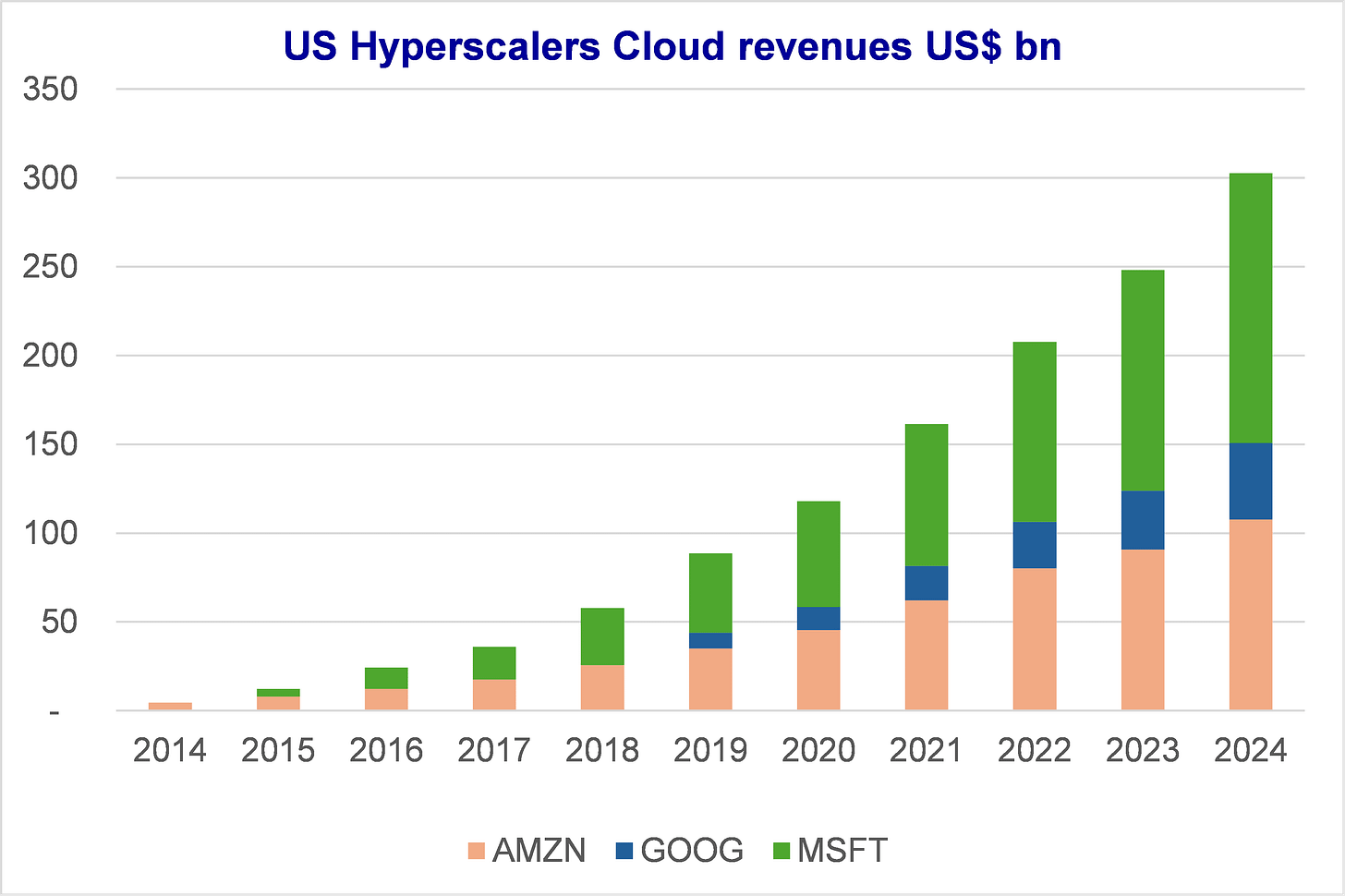

US Cloud Computing providers saw their revenues increase 25x in 10 years (2015 to 2024). AI today is like Cloud in 2014. Do you worry about Capex and small revenues, or do you think about 2035? In the short term, the trajectory of AI stocks depends on the weight of these 2 groups (bears and bulls).

The real risks are:

AI investment (GPU, data center) starts 2-3 years ahead of AI revenues and maybe 5-6 years ahead of profits. The ongoing circular financing reflects that (Nvidia with OpenAi, xAI, CoreWeave or AMD – OpenAI).

For new Technologies, Stock market expectations run on narratives, not a vaguely correct approximation of future profits. You can call that the Gartner’s hype cycle, or herd behavior. 2 books you have to read: Schiller Narrative Economics, Soros Alchemy of Finance (on reflexivity).

=» There’s a timing risk (gap between Capex and Profits), and for stocks a Narrative risk.

But there is bigger upside potential if AI is a repeat of Cloud Computing. An amplified version of Cloud Computing. Read below.

Good summary of the AI bubble thesis in Bloomberg

‘I Believe It’s a Bubble’: What Some Smart People Are Saying About AI. The arguments in favor of an AI bubble, or the warning signs are:

will AI ever produce enough revenue to justify the price? The math is daunting… In 2025 AI technology is expected to generate $60 billion in revenue… Big Tech would need $2 trillion in additional annual revenue to pay for data center expenditures by 2030.

Me: that’s what Lisa Su called “thinking too small”. More on that below in Part 3.

graphics processing units—computer chips for AI account for a significant chunk of data center costs—depreciate quickly. In past bubbles, such as the railroad or the telecom, the overspending at least created lasting infrastructure.

Me: half true (half wrong). Software (AI models in this case) can always use more computing power. GPU or CPU computing power, memory bandwidth are the limitation to software performance. As long as AI software firms can use bigger models, they will buy the latest GPU. It doesn’t mean that older GPU go to the rubbish bin. Older stuff will run smaller / older applications, smaller edge models, etc etc. Older stuff never disappears. Go ask your IT guys what’s the age (min and max) of the servers your company is using. Finally, accounting depreciation time (5 years) and economic life time are very different things.

Bottlenecks could prevent many planned AI factories from reaching completion. While data centers typically take two to three years to build, hooking them up to an energy source can take up to eight years. So it will take that much longer for data centers to begin generating revenue. And that’s if the energy is available at all.

Me: that’s a real dumb argument: if there is no electricity, there is no spending on the data center. Shortage of electricity can slow down AI Capex. Or you think that Google, Meta build data centers without sourcing the power supply?

disappointing performance by the AI tools. A much-cited study by the MIT Media Lab found that 95% of AI projects piloted by businesses have produced no measurable return

Me: this is not the conclusion of the MIT study. Many people wrote “oh my god” article without reading the 1 page summary:

“while individuals are successfully adopting gen AI tools that increase their productivity, such results aren’t measurable at a P&L level, and companies are struggling with enterprise-wide deployments.

most spending on AI experiments goes to sales and marketing initiatives, despite the fact that back-end transformations tend to produce the biggest ROI.

many leaders are making the same mistake they made a decade earlier with digital transformation: encouraging experimentation, which is good, but falling into the trap of letting experimentation run wild, which is counterproductive”

circularity of recent deals—for example, Nvidia Corp. is selling chips to OpenAI while also investing in it—that has echoes of the telecom bubble.

Me: yes warning sign. Vendor financing doesn’t suggest something fishy imo, unlike the internet bubble times when companies with no product and no revenues were buying stuff from each other to cook up revenues. This is not it, Nvidia and OpenAI have real revenues. But this suggests that investments are happening years ahead of future revenues and cash flows. i.e. Nvidia thinks that OpenAI will make a lot of money years later, but doesn’t have the cash to build that capacity today.

growing opacity of funding mechanisms. In August, Meta raised $29 billion for data centers from private credit firms. Big startups such as OpenAI and CoreWeave have also leaned on private credit for data center financing.

Me: that’s a joke. Please tell Apollo, Blackstone, Ares or KKR that they don’t know what they’re doing.

Paul Krugman excellent review of Tech Bubbles

Technology Bubbles: Causes and Consequences

There is a paywall, and I am very respectful of paywalls, so I just extract 1 chart and 2 lines from Krugman’s post. He is not saying that there is for sure an AI bubble.

He is saying:

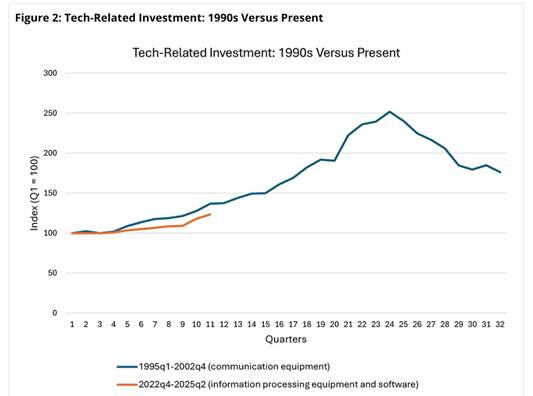

If the AI bubble can be compared to the Telecom /Internet bubble of the late 90s, the AI bubble can keep going for years.

If the AI bubble eventually bursts, it will be a lot worse than the crisis of 1999-2003:

“In the late 1990s the U.S. economy was growing quite rapidly, around 4 percent a year, and the tech boom was only one factor in that growth.

Today, underlying growth is only around 2 percent a year, and so far this year the AI boom has accounted for almost all of the growth. So if that boom goes bust, the consequences for the economy would be much worse than the bust at the end of the 1990s.”

Nicolas Baratte (that’s me): not understanding the potential of AI is a repeat of not understanding Cloud Computing 15 years ago

In 2010-20, I was working for a brilliant investment bank where I was the head of Technology Research.

In 2013, my team and I wrote a series of reports on Cloud Computing and I took a lot of shit for it. The argument was always along these lines: “my on-premise IT works fine, why would I pay a 3rd party to run my applications”.

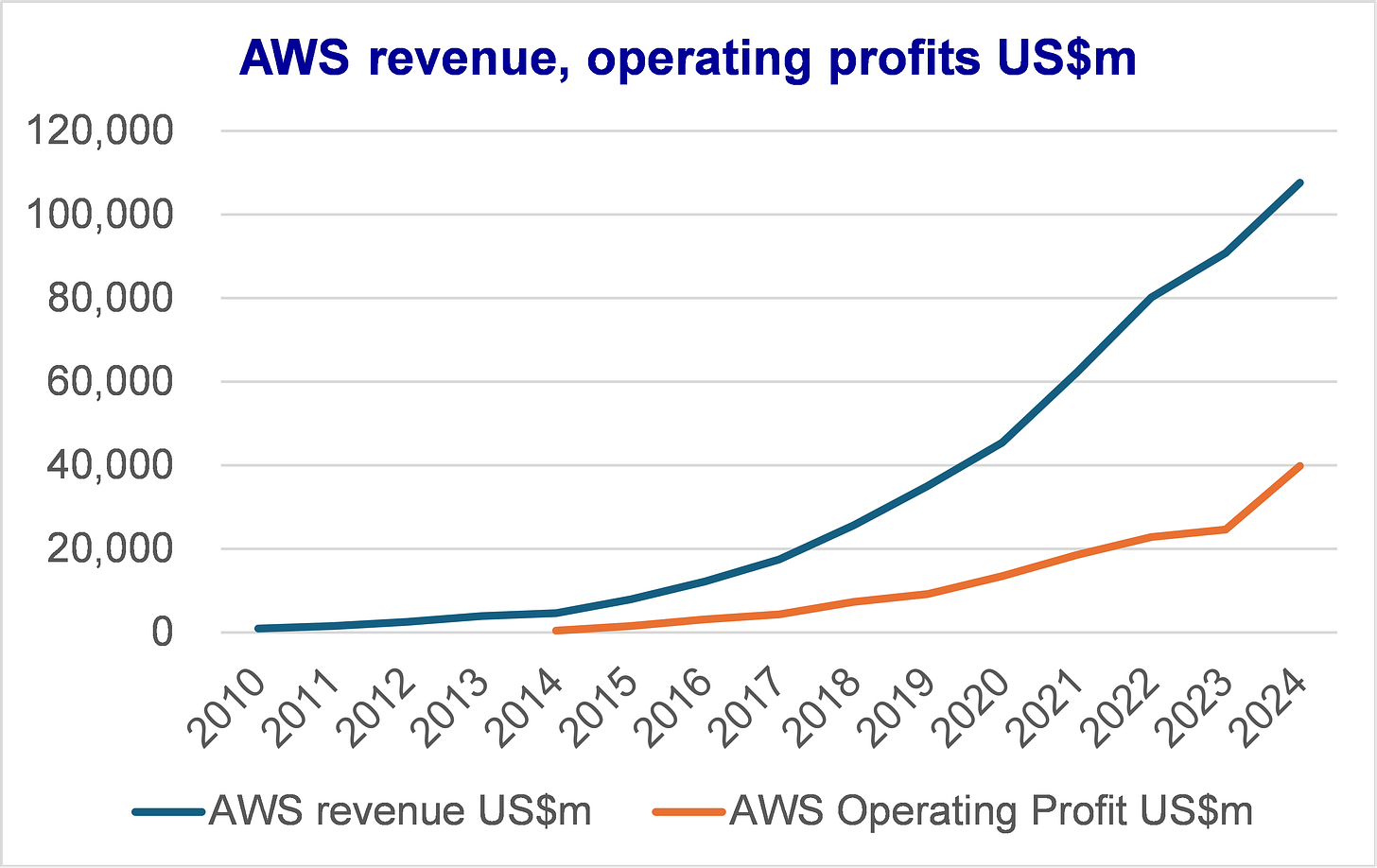

Cloud revenues increased 25x in 10 years

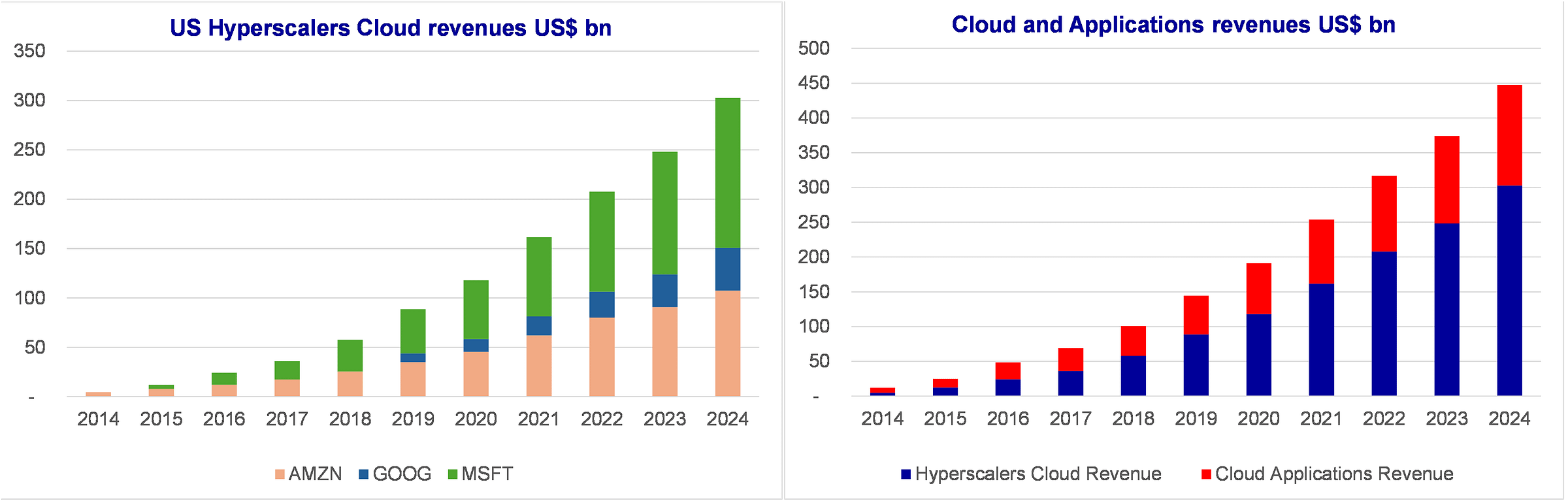

Cloud revenues of the US Big-3, Amazon, Google, Microsoft, have increased by 25x over the past 10 years: from US$12bn in 2015 to $300bn in 2024. The initial stage of growth was predicated on outsourcing economics: pay for what you eat, no capex, no fixed costs, etc.

But very quickly, growth was amplified by something else. Cloud platforms fostered innovation and the creation of a new industry: software or application as a service firms such as Salesforce or ServiceNow.

Then another thing happened: Cloud (and cheaper bandwidth) enabled new business models such as Netflix (the movie streaming, not the DVD rental shops) or Spotify. These Cloud-based firms that barely existed 10 years ago add another $140bn in revenues in 2024, making the total value of Cloud & Applications reach $440bn in 2024. That’s only accounting for the large listed US firms.

The analogy with Cloud Computing is very simple. Just 2 examples.

eCommerce: Cloud enabled new types of data analytics (multi-domain unstructured data) which led to new techniques that improved margins (dynamic pricing) and new functions that increased revenues (recommendation engines).

Physical Commerce: before Cloud, if you had 100 retail stores, you had no idea that this pair of shoes was sold out in store A, but store B had 100 in stocks. Today, you can move stocks, you can do predictive inventories, you increase revenues.

AI similarly enables new disruptive things: it can do stuff that could not be computed before.

new data analytics: language, video, medical imaging, production flows, road traffic… AI can read an invoice that you receive in pdf, automatically input in your ERP, automatically link to production and inventories. AI is reading companies videos for me, it reads transcripts for me. AI opens up new domains of Automation. Automation lowers costs.

new applications: automation of document drafting, commercial contracts or medical reports; automation of image / video generation; modelling of the physical environment, drug development, etc. AI enables new Applications. Applications are revenue.

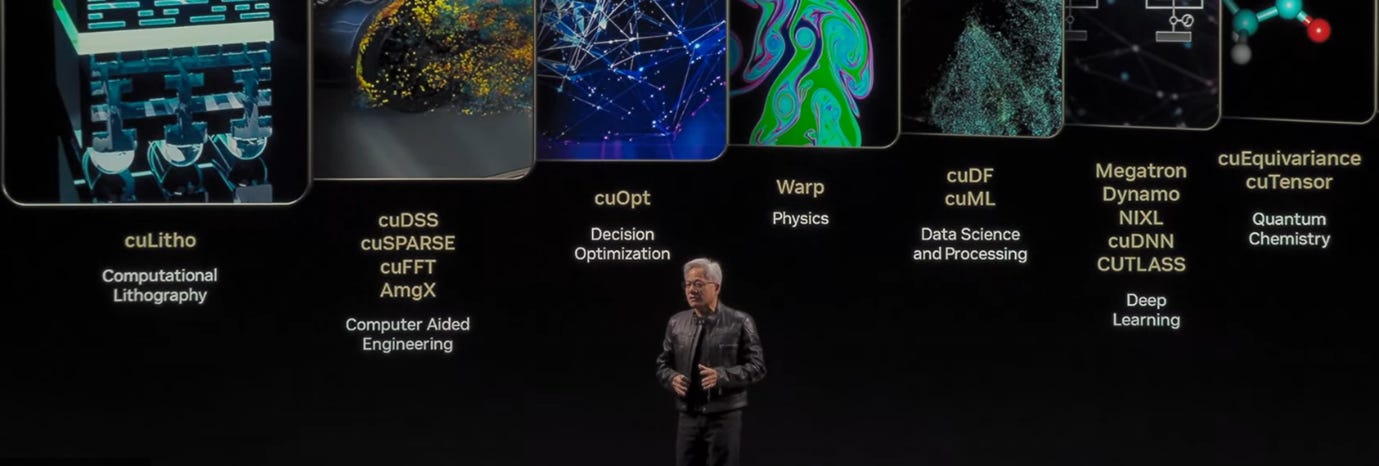

AI is a platform, it has a compounding effect. Listen to Jensen Huang presentations (latest here at Computex Taipei, especially at min 20-30 and the last 30 mins), he explains the platform effect: accelerated computing can be applied to anything where there is a computing bottleneck. From lithography (semiconductor manufacturing), to decision optimization (supply chain management), to chemistry (developing new molecules).

Nvidia will not provide these applications, it provides computing power (GPU) and a software development platform (CUDA) that allows other firms to develop applications. Like conventional Cloud Computing, Accelerated Computing has an infinite compounding effect.

new data analytics => new applications => new business models

Ok but where are AI revenues, profits, “there is no ROI”

Don’t panic and just look back. For years, AWS was making very small revenues and was loss-making.

From 2010 to 2013, it was basically a developer’s tool, large firms testing. Lots of Capex, insignificant revenues. Does it sound familiar?

From 2014 to 2017, commercial adoption took off, but profits were thin.

So it was a ~7 years journey from exciting pilots and demos to significant profits that move the stock price.

That’s the reality of Tech and the large disconnect with stock prices. New computing, new architectures take many years to reach commercial maturity. Stock investors expects profits next year.

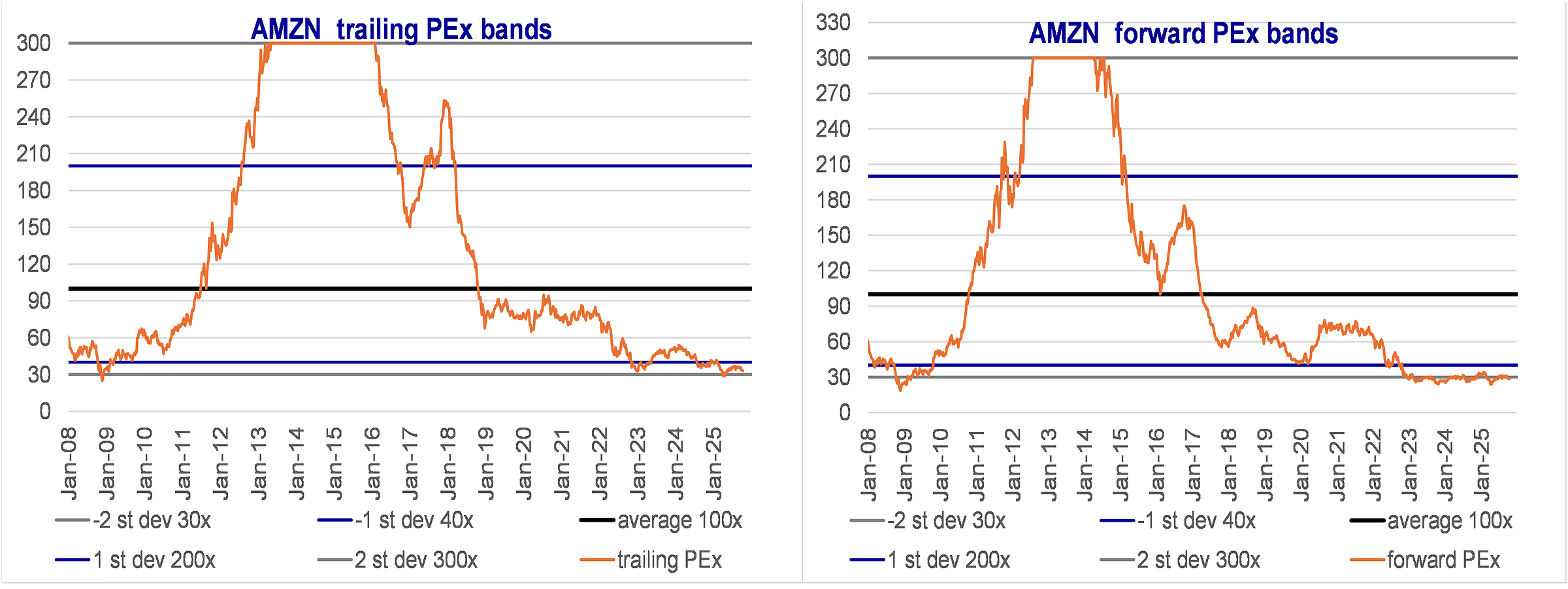

During all that “incubation” period, Amazon AMZN was trading at 100x EPS. Or more (2 periods of losses, charts below are capped for that reason). AMZN traded above 100x earnings from July 2011 to October 2018.

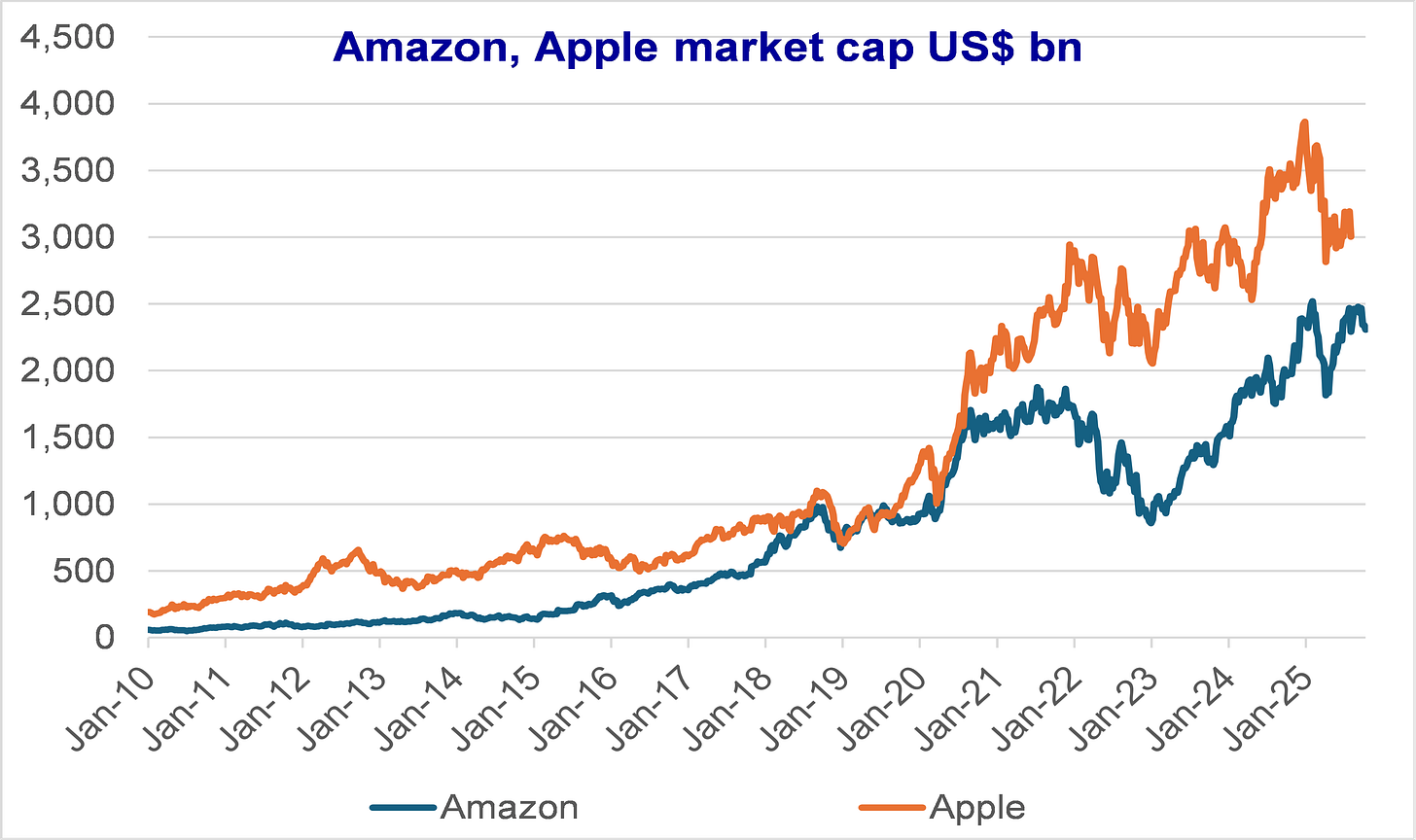

How is this possible? Because some smart investors understood the earnings potential of Cloud Computing (AWS). Because these investors were very patient. Because Warren Buffet never understood. If you want cash flows and dividends, if you can’t understand the technology, please buy an old style brand that sells hardware: Apple. You will be ok.

https://open.substack.com/pub/techitalt/p/are-we-in-an-ai-bubble?r=5jmutn&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true