TSMC June revenue dropped -18% MoM. OMG what’s going on? First it’s not a miss, 2Q revenues are spot inline with guidance. Second, the NT$ has appreciated by 13.5% in 2Q.

Do not trade big monthly sales move

TSMC June revenue dropped -18% MoM. It doesn’t happen often, but it does.

1) monthly sales are notoriously volatile

2) April-June revenues reach NT$994bn, guidance was 996bn = not a miss

3) NT$ appreciated by 13.5% during 2Q and that will remain a drag in 3Q.UMC April-June revenue miss its 2Q guidance by 6%. NT$ appreciation is similarly a problem but the miss also reflects that demand for Legacy semiconductors remains weak (consumer electronics, automotive, industrial, etc). That’s 100% of UMC revenue and 30% of TSMC revenues.

Depending on what’s the kommentariat is busy with, this could have a negative impact on the share price. Or maybe US import tariffs win the battle for attention today. Don’t trade this and wait for TSMC reporting on 17 July, UMC on 30 July (tbc).

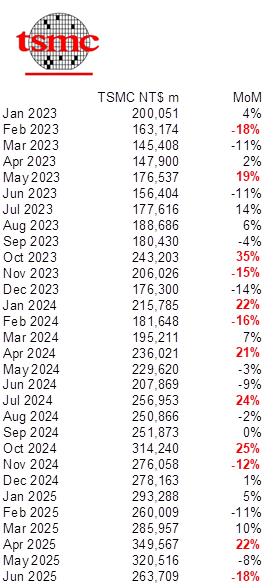

June 2025 monthly sales: the data

TSMC reported June 2025 revenues at NT$ 264bn, +27% YoY and -18% MoM.

UMC reported June 2025 revenues at NT$ 18.8bn, +7% YoY and -3% MoM.

Monthly sales are notoriously volatile

The table below shows TSMC monthly revenues since Jan-23. The numbers in red are the big MoM move, positive or negative. As you can see, a big positive or negative move happens very often. These big moves don’t give you a clear indication of the overall trend, that you can see in the 1st chart above.

As a general comment: do not trade big monthly sales move.

April-June revenues are inline with guidance for TSMC, a miss for UMC

TSMC

2Q revenue guidance was based on 1 US$ to 32.5 NT$

Guidance was revenue US$ 28.8bn * 32.5 = NT$ 936bn

April to June revenues are NT$ 934bn. Inline.

UMC

does not provide a revenue guidance but “wafer shipments will increase by 5% to 7% sequentially. ASP in USD terms will remain flat”.

We know shipments, we know US$ ASP, using TSMC’s Forex that means 2Q revenue “guidance” was NT$ 62.5bn.

April to June revenues are NT$ 58.8bn or -6% below guidance. It’s a miss.