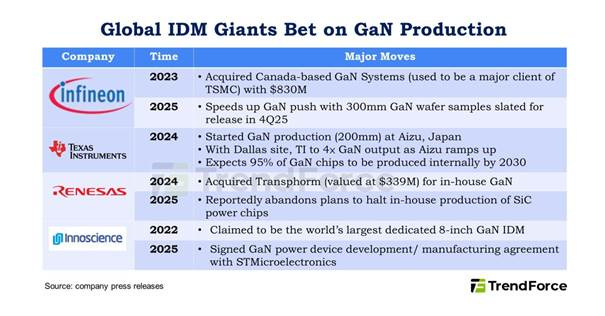

Power GaN coming oversupply, an illustration. The fear is a repeat of the SiC situation (large capacity built in China, Wolfspeed filling for bankruptcy protection)

Samsung delays A14 to focus on 3-2nm. Samsung and Intel have the same problem: yields are too low to attract customers. Claims of being the first to do this or that are useless if yields are 40%.

Chinese GPU are coming – or IPO are coming? Moore Threads and MetaX approved to list in Shanghai. Tiny revenues, lots of spending on R&D. Biren Technology is expected to file in Hong Kong.

Power GaN coming oversupply, an illustration

Few days ago I wrote that TSMC exiting Power GaN for Automotive was due to poor margins and too much competition. Some people answered that Power Gan is the future. Sure, but here you go: TrendForce has a nice chart to illustrate the over-supply / over-competition problem.

Semi manufacturing: bragging claims or profitability?

I mentioned that Qualcomm was trying to qualify Samsung Foundry at 2nm. Now it seems that Qualcomm had 2 test chips, one at Samsung and one at TSMC and that Qualcomm is dropping Samsung due to poor yields. This is triggering a strategy rethink at Samsung:

Delay Texas Taylor $44bn Fab as there are no Foundry customers as long as yield are poor

cutting Foundry capex by half or more in 2025

Delay 14A node to put resources on improving 3nm and 2nm, or increase yields from probably ~40-50% now to Mass Volume Production MVP levels at ~70-80%. Which could attract customers.

The important conclusion here, for people who don’t follow semi manufacturing closely, is that:

Bragging claims are useless. For ex:

Samsung first with GAA

Intel first with High NA EUV

Intel first with Back Side Power rail

What matters is: can you manufacture in high volumes (say 100k wafer/months) with high yields (~80%). If scale and yields are too low, there are no external customers. That’s the situation that Samsung Foundry and Intel Foundry are in.

Samsung Foundry is losing US$3-4bn per year. Gross Margin probably 0% to -5%, Operating Margin -15%

Intel Foundry is losing US$8-9bn per year. Gross Margin probably -20% to -25%, Operating Margin -55%

TSMC Gross Margin 55%, Operating Margin 45%

Samsung 4-7nm wafers are 30% cheaper than TSMC

Korean news here.

In older nodes (28nm to 12nm), Samsung was always “cheaper” than TSMC by 15-20%.

Is the discount becoming larger? That doesn’t make intuitive sense when the Korean chitchat is that Samsung Management is fed up with Foundry losses and wants a solution – while suspending Foundry investments in the mean time (links above).

For people who don’t follow semi manufacturing closely, the truth about “wafer price” is that:

Wafer prices are in a range

For example, TSMC sells a 3nm wafer to Apple for $18k. A 3nm wafer to Nvidia will cost $22k. That’s not because Apple is getting a huge discount, as you sometimes read in the media.

It’s because the price of the wafer depends on the number of lithography layers aka metal layers on the wafer: how much material cost, how much machine time. An Apple iPhone chip has 12 metal layers. An Nvidia Blackwell GPU has 16 metal layers.

Wafer prices are adjusted for yield.

Apple has 600 iPhone chips on its wafer. The TSMC wafer price formula is like this: if there are 480 good chips on the wafer, or an 80% yield rate, the price of the wafer is $18k.

If there are more good dies (higher yield), the wafer price is higher. At the opposite, lower yield, lower wafer price.

So when media ways that Samsung is 30% cheaper than TSMC, maybe it’s the case but 1) for what products (how many metal layers) 2) at what yield rates? This is the kind of news that says nothing.

Chinese GPU are coming – or IPO are coming?

I reviewed here the latest Chinese GPU. Since then, Moore Threads and MetaX have applied for IPO and obtained approval from Shanghai STAR Market on 30 June.

Moore Threads plans to raise RMB 8bn. pre-IPO valuation RMB 24.6bn (CITIC Securities)

From 2022 to 2024, Moore Threads' cumulative revenue was RMB 609m. Net loss RMB 5bn.

From 2022 to 2024, Moore Threads has spent RMB 3.8bn in R&D.

Moore Threads was founded by ex- Nvidia staff in China. Chairman Zhang Jianzhong was previously Nvidia’s China operations as general manager.

MetaX aims to raise RMB 3.9bn (Huatai Securities)

From 2022 to March 2025, Muxi's cumulative revenue was RMB 1.2bn. Net loss RMB 3.3bn

MetaX has spent RMB 2.2bn in R&D.

MetaX was founded by ex-AMD staff in China,. Chairman Chen Weiliang was previously AMD’s global head of GPU product design.

Biren Technology is expected to file for IPO in Hong Kong