Nvidia 1Q26: the good times keep rolling, the stock is not expensive

The impact of loss of H20 sales to China is a lot less than I feared

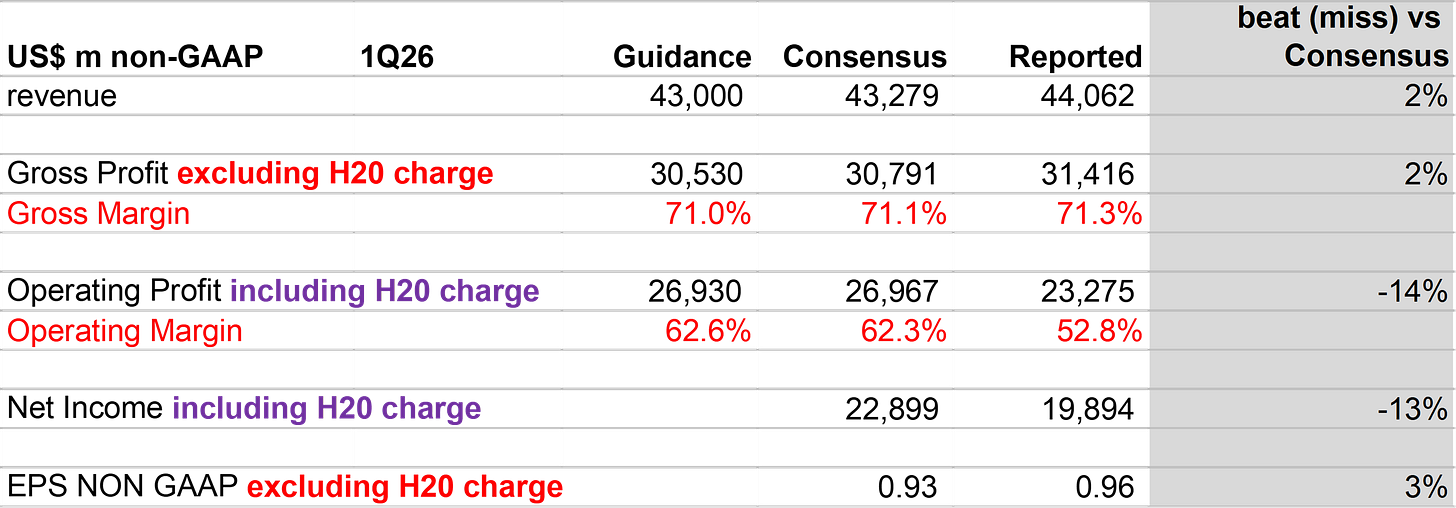

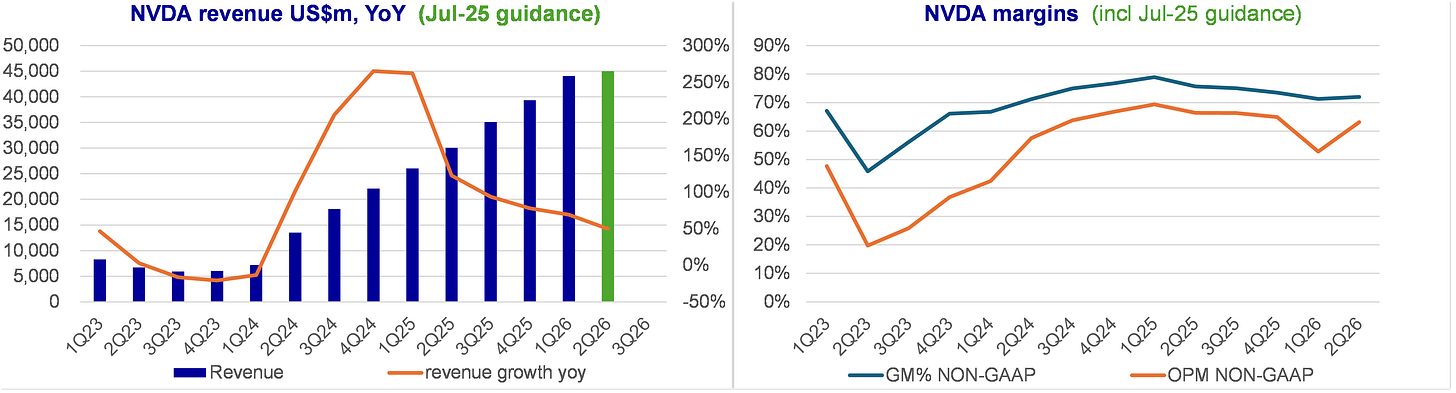

Large impact of H20 discontinued sales to China, but less than I thought. Including the impact, 1-2Q26 are inline with consensus. Adding back the H20 missed revenues, 1-2Q26 would have been ~10% above Consensus.

The ramp of GB200 is very impressive, demonstrating Jensen's point: "it drives down cost and improves quality of response with higher speed". The Good Times Keep Rolling.

This means that Consensus most likely does not need to revise down FY26 forecasts. This means that the stock is cheap-ish, trading at 31x FY26 EPS and 24x FY27.

Bottom line: the impact of loss of H20 sales to China is a lot less than I feared in Nvidia’s Jensen loudly complaining about export restrictions to China: how much is at stake? Quite a lot.

April-25 Quarter (1Q26): would have been strong – except for US restrictions on H20 sales to China

An H20 inventory provision of US$4.5bn (last quarter, Nvidia guided for $5.5bn+)

$4.6bn H20 revenues to China

$2.5bn H20 missed revenues

“On April 9, 2025, NVIDIA was informed by the U.S. government that a license is required for exports of its H20 products into the China market. As a result of these new requirements, NVIDIA incurred a $4.5 billion charge in the first quarter of fiscal 2026 associated with H20 excess inventory and purchase obligations as the demand for H20 diminished. Sales of H20 products were $4.6 billion for the first quarter of fiscal 2026 prior to the new export licensing requirements. NVIDIA was unable to ship an additional $2.5 billion of H20 revenue in the first quarter.”

Gross Margins non-GAAP 61.0%

Excluding the $4.5 billion charge: 71.3%.

EPS non-GAAP $0.81

Excluding the $4.5 billion charge: $0.96.

Nvidia didn’t quantify the impact on Operating Profit / Net Income, so careful on the table below:

Including H20 charges 1Q26 is a -13% miss

Excluding H20 charges 1Q26 is a 3% beat

If you add the $2.5bn of H20 missed revenues, it would have been a ~10% beat

Other comments:

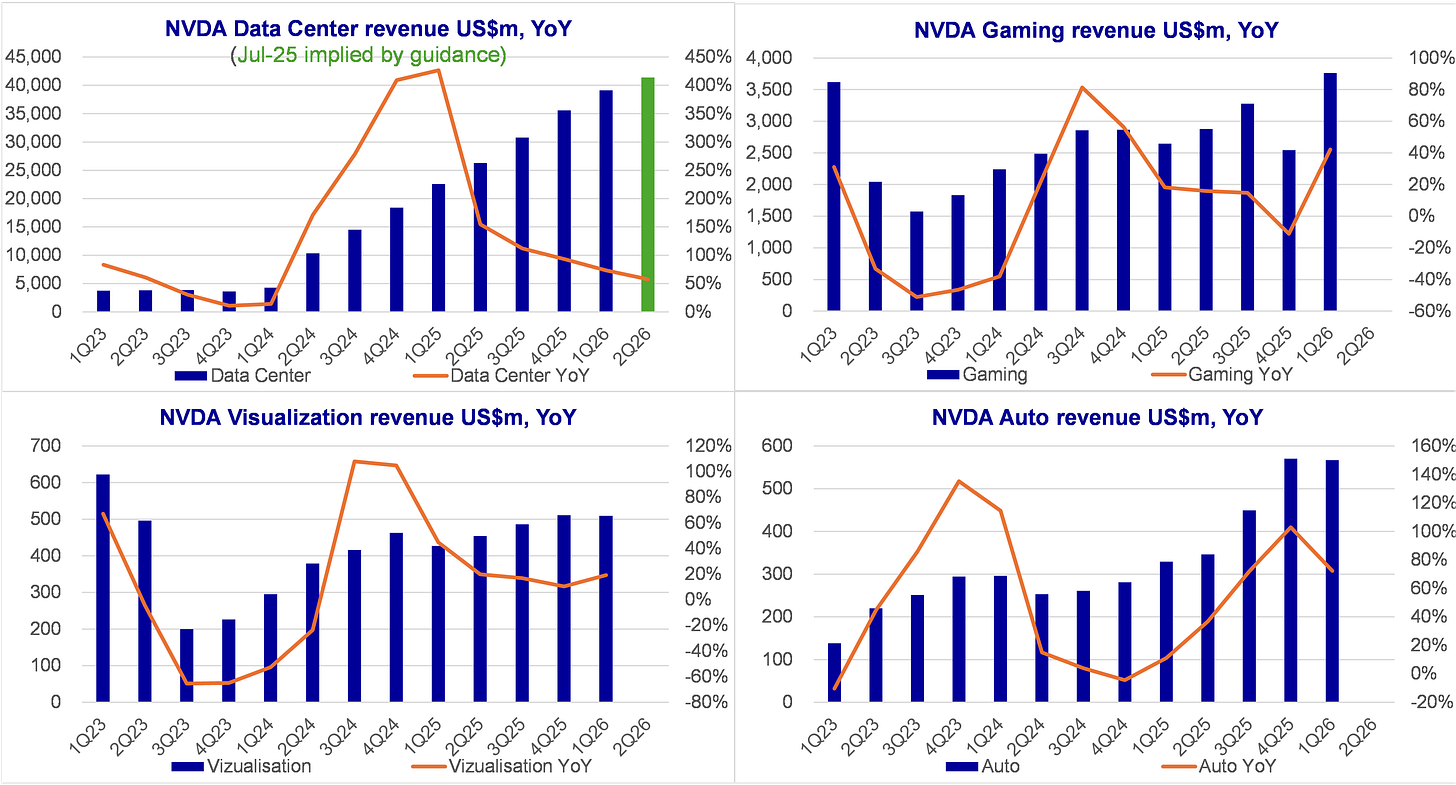

Data Center compute revenue $34.2 bn, up 76% YoY and up 5% QoQ

Blackwell architecture ramp expand to all customer categories,

large cloud service providers remained at just under 50% of Data Center revenue

Networking revenue $5.0 bn, up 56% YoY and up 64% QoQ, driven by the growth of NVLink compute fabric in GB200 systems

Gaming revenue $3.7bn, up 42% YoY and up 48% QoQ, driven by sales of Blackwell architecture

Professional Visualization $0.5bn up 19% YoY and flat QoQ

Automotive $0.6 bn, up 72% YoY and down 1% QoQ.

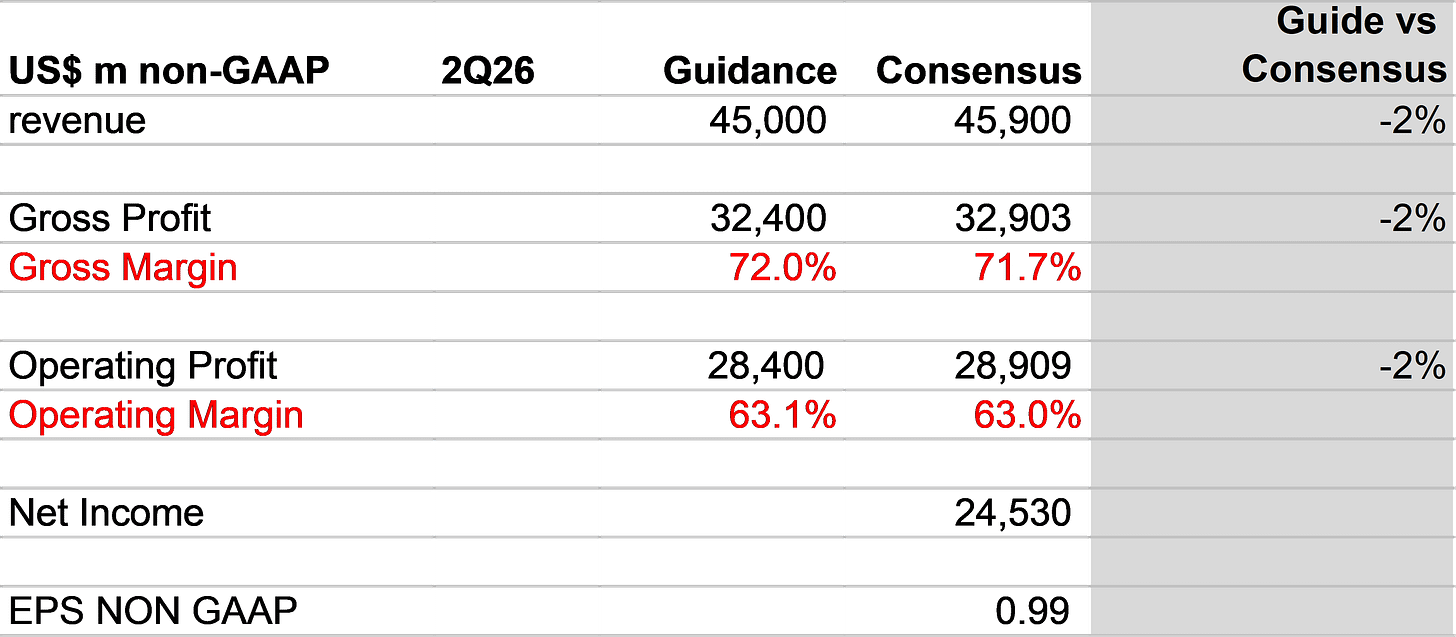

Jul-25 Quarter (2Q26): inline despite missing US$8bn in H20 revenues

Revenue $45.0 bn. Loss in H20 revenue estimated at $8.0 bn.

non-GAAP gross margins 72.0%

non-GAAP operating expenses $4.0 bn

implying OP $28.4bn

this is -2% below Consensus

If you add back the $8bn missed H20 revenues, 2Q26 would be ~12% above Consensus

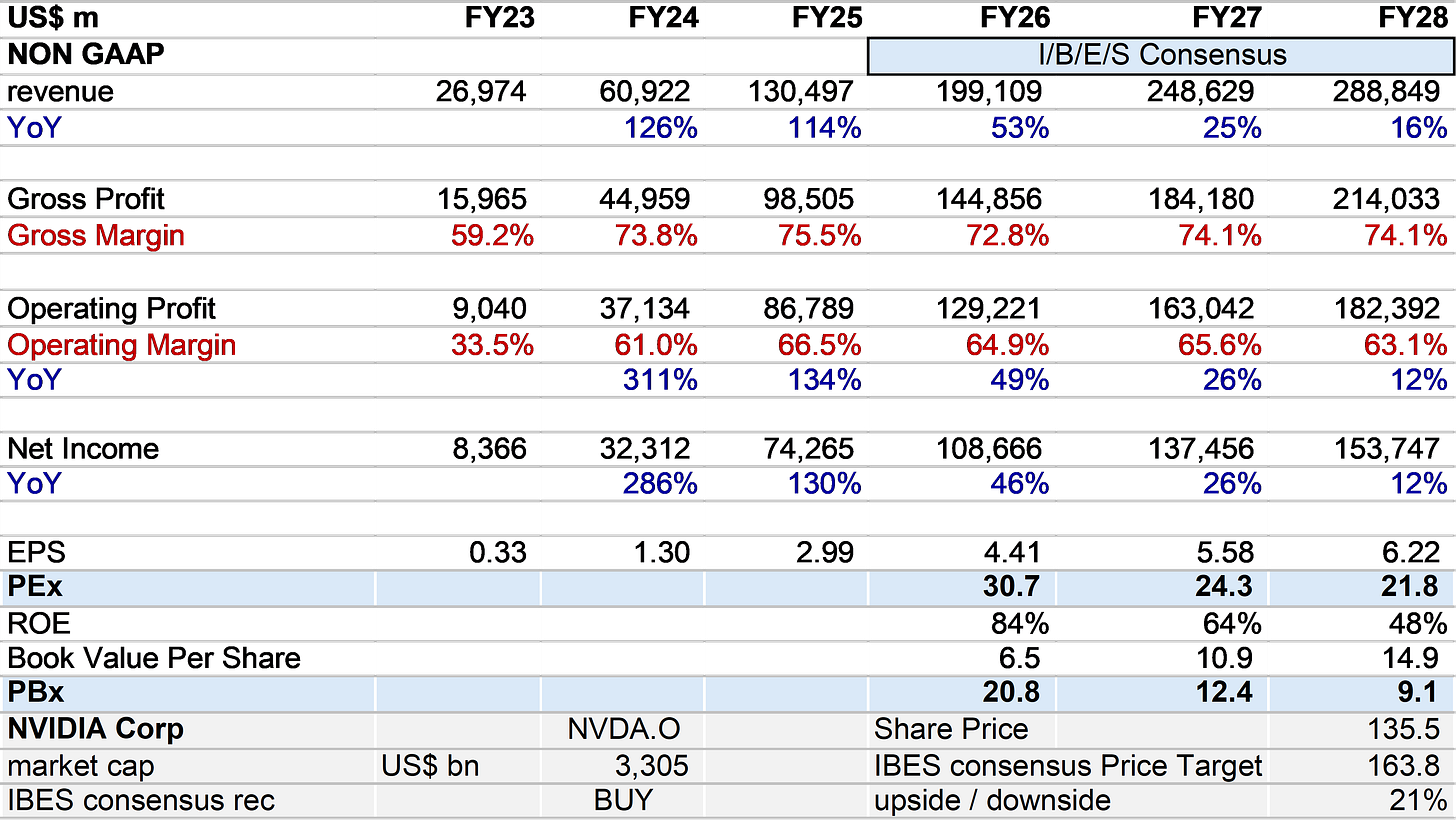

Consensus forecasts, Valuations

The very good news is that despite the loss of H20 revenues, and no replacement chip before end of 2025, Nvidia’s 1Q and 2Q26 are inline with consensus. This means that Consensus most likely does not need to revise down FY26 forecasts.

FY27 forecasts remain, in my opinion, on the low-end with revenue growth declining sharply to 25% YoY.

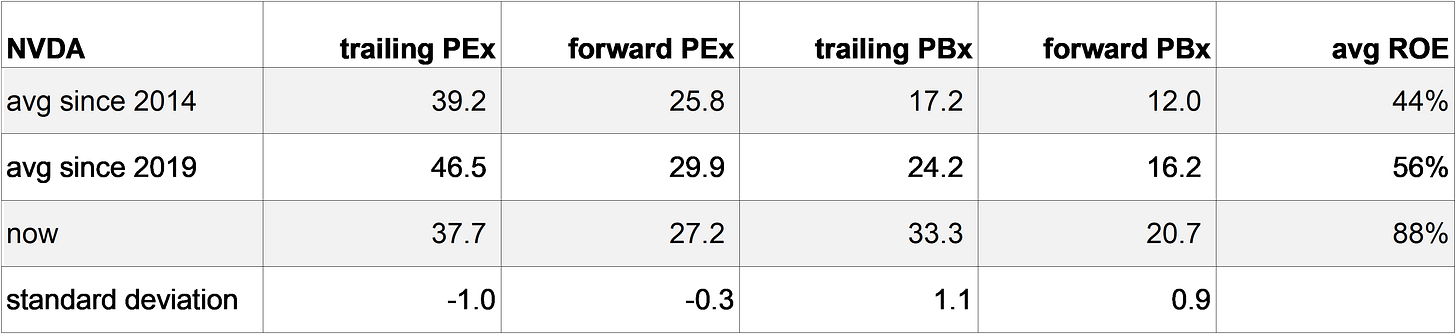

This means that the stock is cheap-ish trading at 31x FY26 EPS and 24x FY27

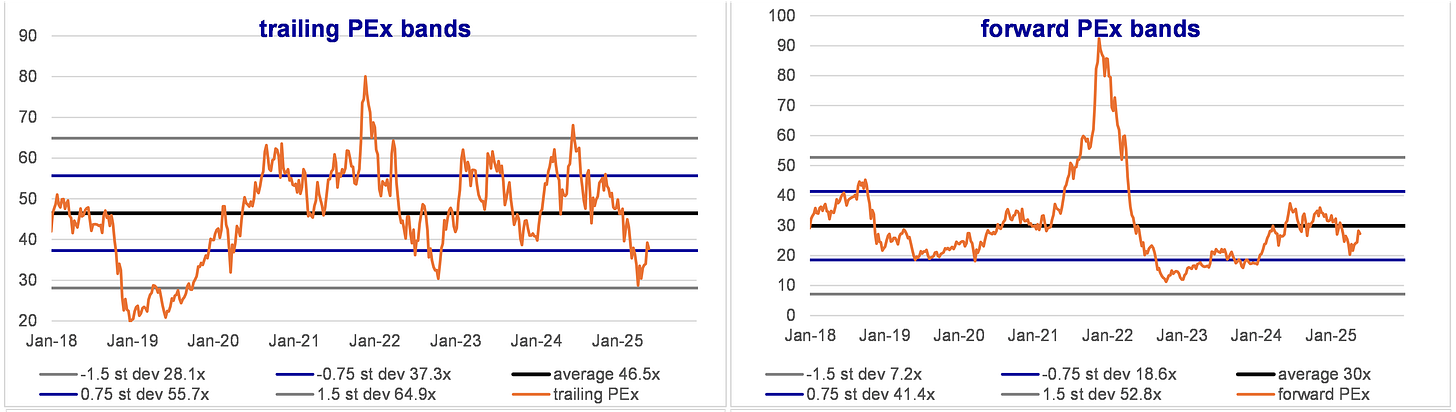

Trailing PEx is -1 standard deviation below average

Forward PEx is -0.3 standard deviation below average

All that is positive to TSMC and SK Hynix.