MTK 2Q25: inline but positive one-off. Very weak 3Q with revenue decline QoQ and margins compression. Management remains very bullish on AI and Auto, and that’s a problem for the share price

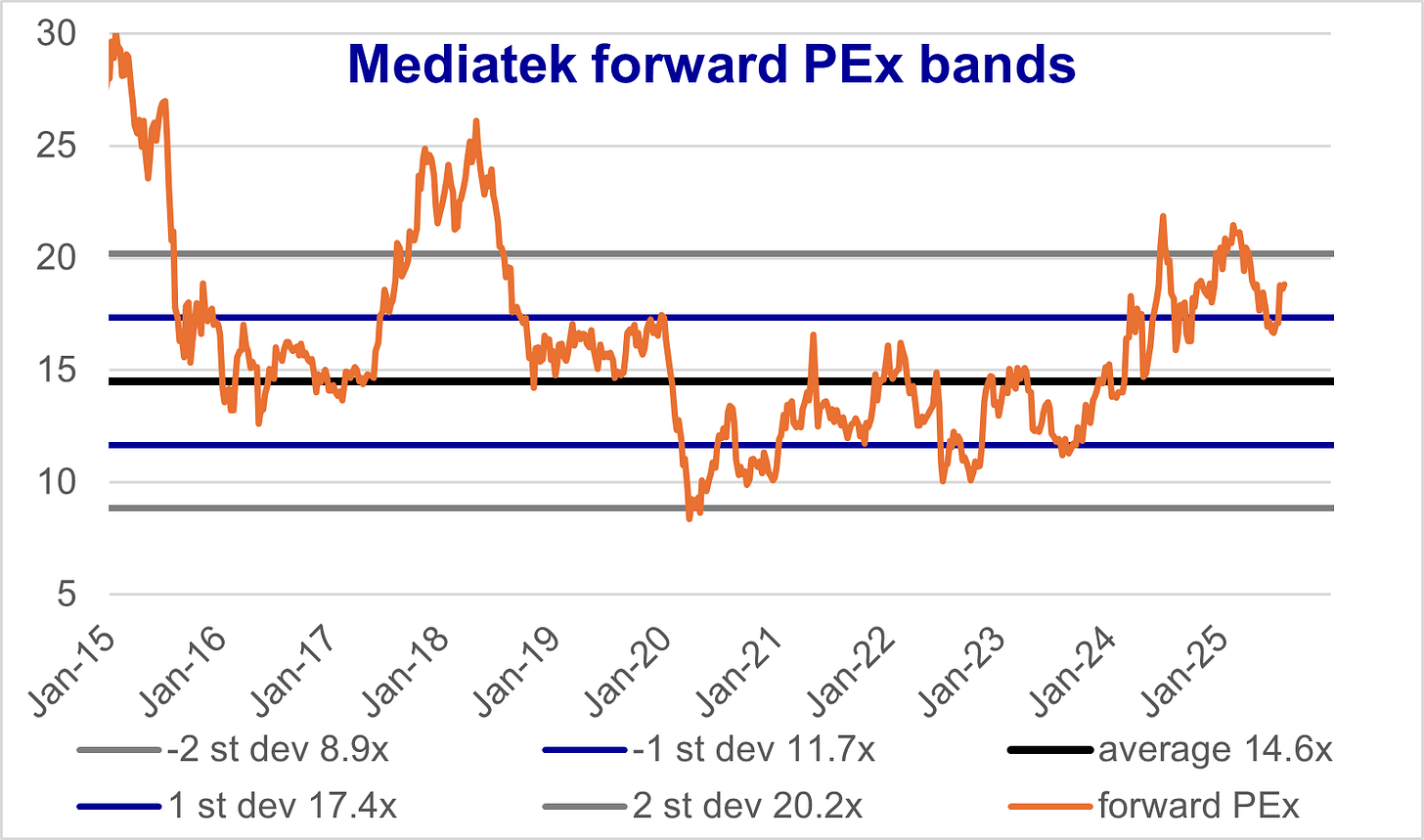

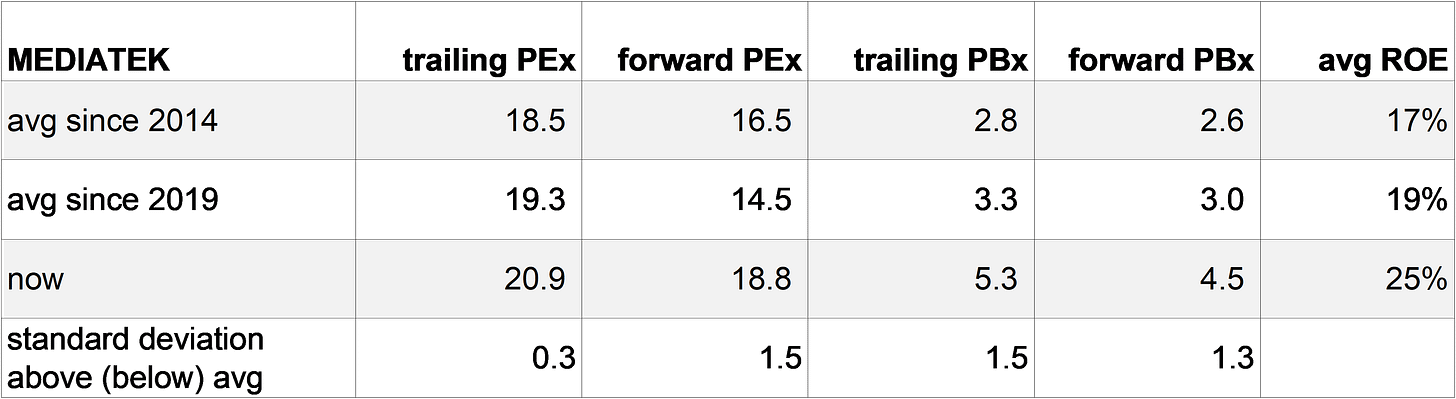

expectations and valuations are high

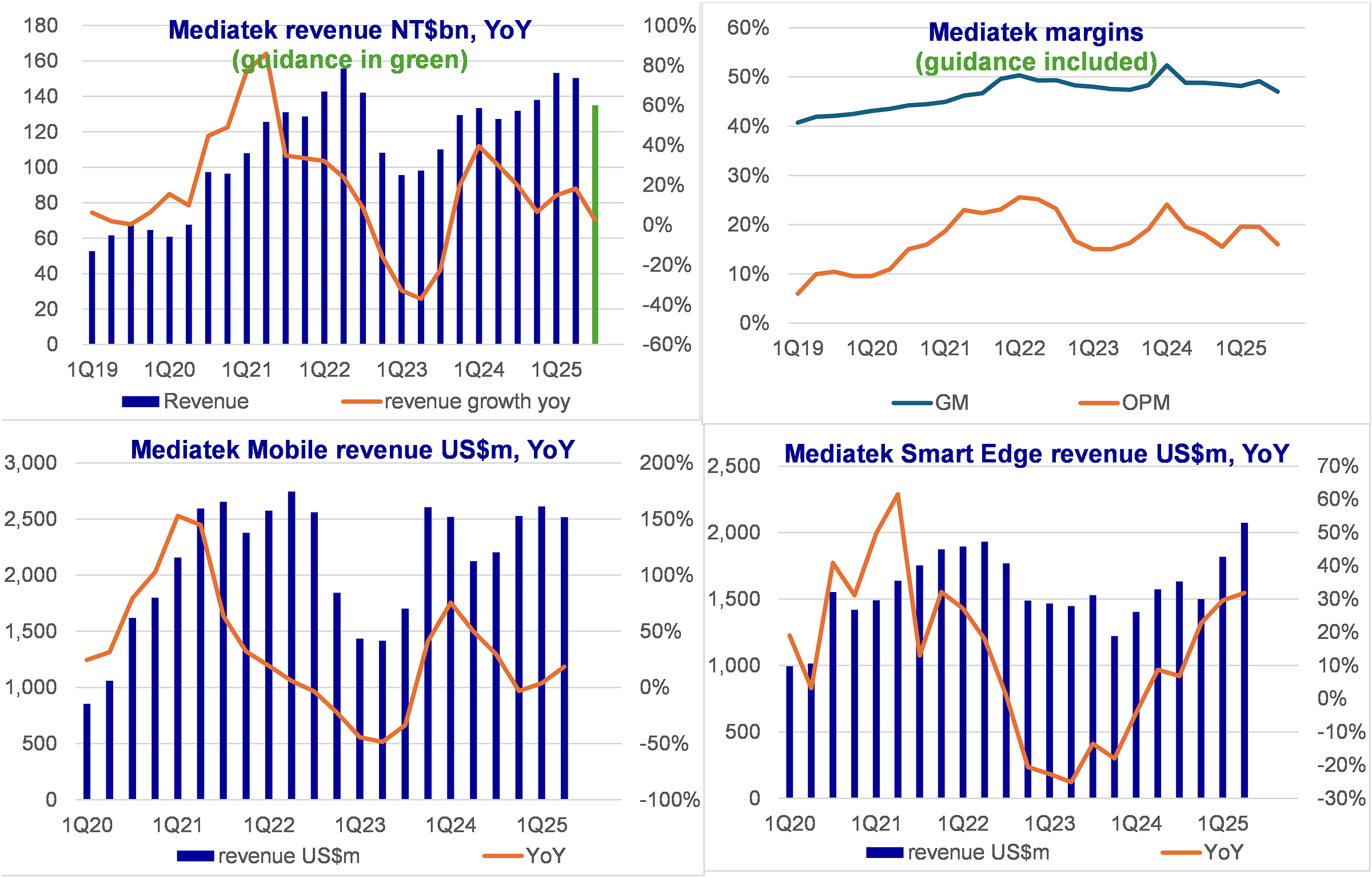

2Q25: inline despite NT$ appreciation, helped by a gross profit one-off.

3Q25: large FX impact but still revenue decline QoQ in NT$ and US$. 2nd consecutive quarter of Mobile revenue decline. Edge also to decline QoQ due to pull-in in 2Q. Add margins compression and 3Q guidance is a large miss: OP -20% below Consensus.

Management continues to provide very bullish “indications” on growth from 2026-27: AI ASIC, collaboration with Nvidia, Automotive. Multiple analysts questions on risk of hyperscalers projects delayed or cancelled.

The problem here is that management’s bullish tones becomes high consensus expectations and high stock valuations, leaving space for disappointment like a very weak 3Q25.

I do agree that Mediatek is entering very large markets (AI ASIC, Auto) that will provide new growth beyond the exhausted Mobile market. You want to buy into this after the stock corrects ~20%.

If you read my posts – thank you.

If you wonder where I don’t have a paywall: news comments, industry comments, posts based on public news.

Where there is a paywall: company results, financials, forecasts, valuations. There is a paywall below.