Micron #2. 3Q25 earnings beats by 13%, 4Q guidance beats by 14%. Consensus forecasts for FY25 are ok, FY26 slightly low, FY27 too low by 25-30%

Results and Guidance beat, driven by HBM very fast growth. HBM also generates higher margins and sucks up DRAM capacity, a secondary benefit.

HBM is still in year-2 of a 5-year journey. Industry revenues double in 2025 and Micron HBM revenue increase 5x in FY25 from a very low base. Expect Micron HBM to double in FY26.

Consensus is a tad too low for FY26, likely 10% too low. Consensus is very low for FY27, likely 25-30% too low. It’s hard for the sell-side to forecast hyper-growth

Background on HBM market size and growth here

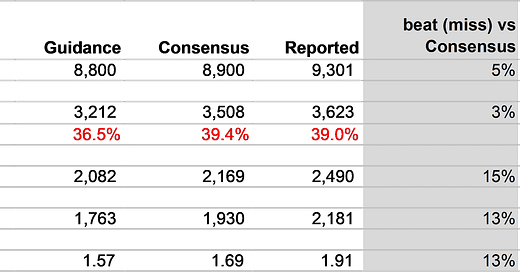

3Q25 (May-25) is a large beat on HBM higher growth and positive impact on ASP and margins

Micron Technology (MU US) HBM increase “nearly” 50% QoQ (I assumed 45% below) and 380% YoY. This is why data center revenue are up 100% YoY.

HBM has a very large positive effect on ASP as HBM ASP is 4-5x higher than conventional DRAM and also on Margins as HBM operating margin is ~45% versus conventional DRAM ~25%

DRAM is not bad at +10% QoQ, some positive ASP effect, some fears of restocking due to US import tariffs but management thinks its marginal. This implies that DRAM demand is now close to end-markets demand – but still the largest driver should be Servers.

NAND +16% QoQ

4Q25 (Aug-25) guidance is a large beat, suggests due to HBM again

Revenue 6% above Consensus

Gross / Operating profits 10% and 16% above Consensus

This suggests that the revenue upside is driven by a higher margin product, and again that’s HBM.