Jensen went to the White House, and to China

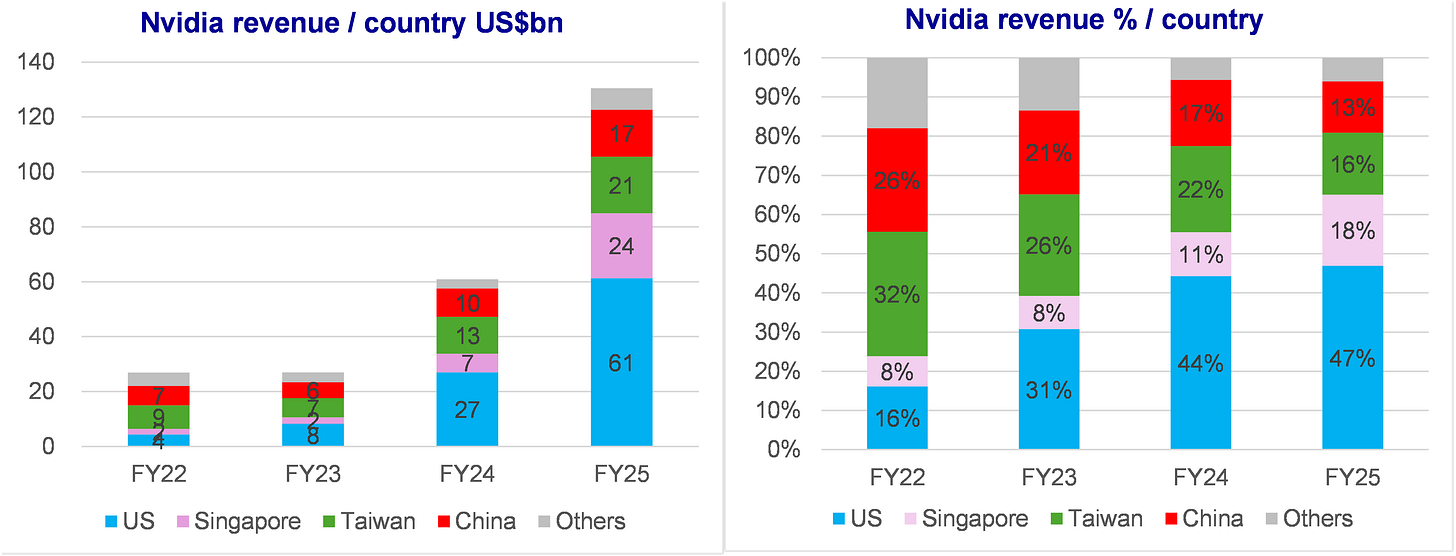

for Nvidia, AI GPU revenues from China at US$ 30-35bn (15-17% of total)

On June 5, I published US – China: Restrictions on Semiconductors Are Getting Worse

On July 15: Restrictions are relaxed. EDA tool (Cadence, Synopsys) already relaxed, Nvidia says export license will come, this implies that HBM can be sold to China.It’s really hard to “guess” what comes next as US restrictions on technology export to China are just one bargaining tool in much broader negotiations (trade deficit, fentanyl, etc).

For Cadence and Synopsys, China was 12% of revenues in 2024. For Nvidia, China is US$ 30-35bn of revenue in 2025 (15-17% of total). If Nvidia gets export license for its China-specific chips, it’s very positive to Samsung which supplies HBM3 in Nvidia’s H20, and GDDR7 in the newly announced RTX PRO.

Where this comes from – chronology

9 April

Nvidia issues a SEC filling: export license is required for the China-specific H20 chip

“On April 9, 2025, the U.S. government, or USG, informed NVIDIA that the USG requires a license for export to China (including Hong Kong and Macau) and D:5 countries, or to companies headquartered or with an ultimate parent therein, of the Company’s H20 integrated circuits and any other circuits achieving the H20’s memory bandwidth, interconnect bandwidth, or combination thereof.

28 May

Nvidia 1Q26 financial release

NVIDIA incurred a $4.5 billion charge in the first quarter of fiscal 2026 associated with H20 excess inventory and purchase obligations as the demand for H20 diminished.

In April-25 quarter (1Q26) Nvidia sold US$4.6 billion of H20, but was “unable to ship $2.5 billion due to the new export controls”. So total market demand: $7.1bn

In July-25 (2Q26) “our outlook reflects a loss in H20 revenue of approximately $8 billion”

Nvidia could have sold US$15bn of H20 chips to China in 1H26, annualized $30bn or a bit more.

28 May

Pres. Trump “orders US chip software suppliers to stop selling to China”. China represents 12% of revenues for both Cadence and Synopsys. China has a number of startup working on replacement software, the leader is Empyrean – good but some years behind Cadence and Synopsys and focused on legacy chip design .

2 July

On July 2, Synopsys received a letter from the Bureau of Industry and Security of the U.S. Department of Commerce informing Synopsys that the export restrictions related to China, pursuant to a letter received on May 29, 2025, have now been rescinded, effective immediately. Synopsys is working to restore access to the recently restricted products in China. Synopsys is continuing to assess the impact of export restrictions related to China on its business, operating results and financials.

Nvidia can resume selling H20 to China

Nvidia released here on its blog:

This month, NVIDIA founder and CEO Jensen Huang promoted AI in both Washington, D.C. and Beijing.

In the U.S. capital, Huang met with President Trump and U.S. policymakers, reaffirming NVIDIA’s support for the Administration’s effort to create jobs, strengthen domestic AI infrastructure and onshore manufacturing, and ensure that America leads in AI worldwide.

Huang provided an update to customers, noting that NVIDIA is filing applications to sell the NVIDIA H20 GPU again. The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon. Finally, Huang announced a new, fully compliant NVIDIA RTX PRO GPU that “is ideal for digital twin AI for smart factories and logistics.”

Samsung supplies HBM3 for H20

RTX PRO 6000 (formerly B40) is a downgraded Blackwell, without HBM. Samsung should be the exclusive supplier of GDDR7 for this chip.

More generally, Samsung is the leader in the GDDR7 market with ~ 70% market share