Intel is shrinking (headcount), declining (market share), but weakness can be a strength

Weakness can breed strength, involuntarily.

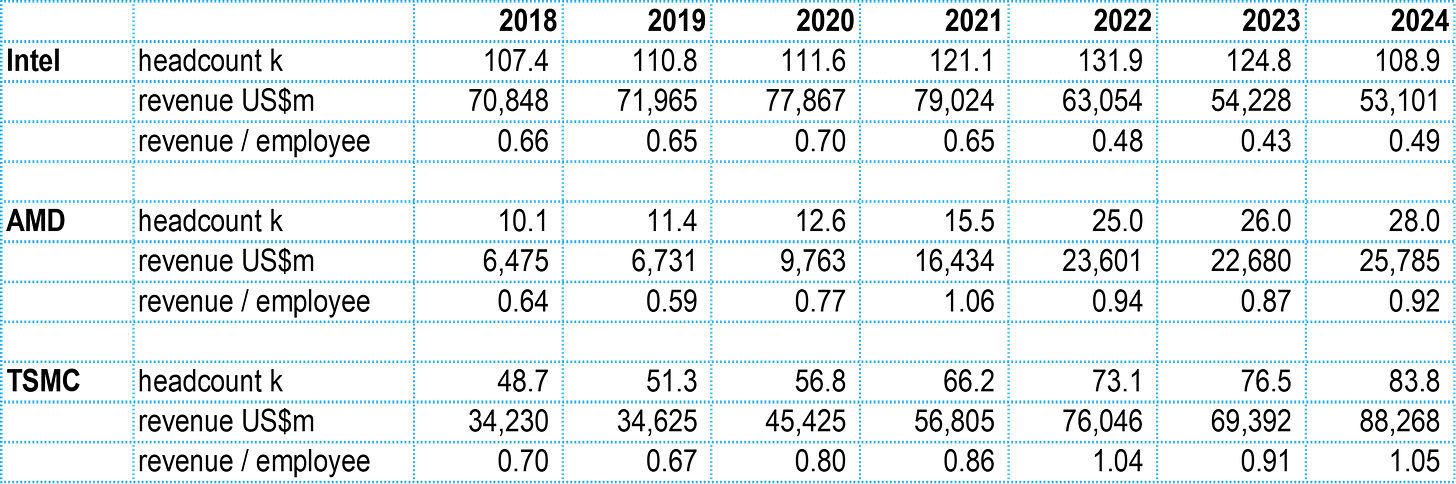

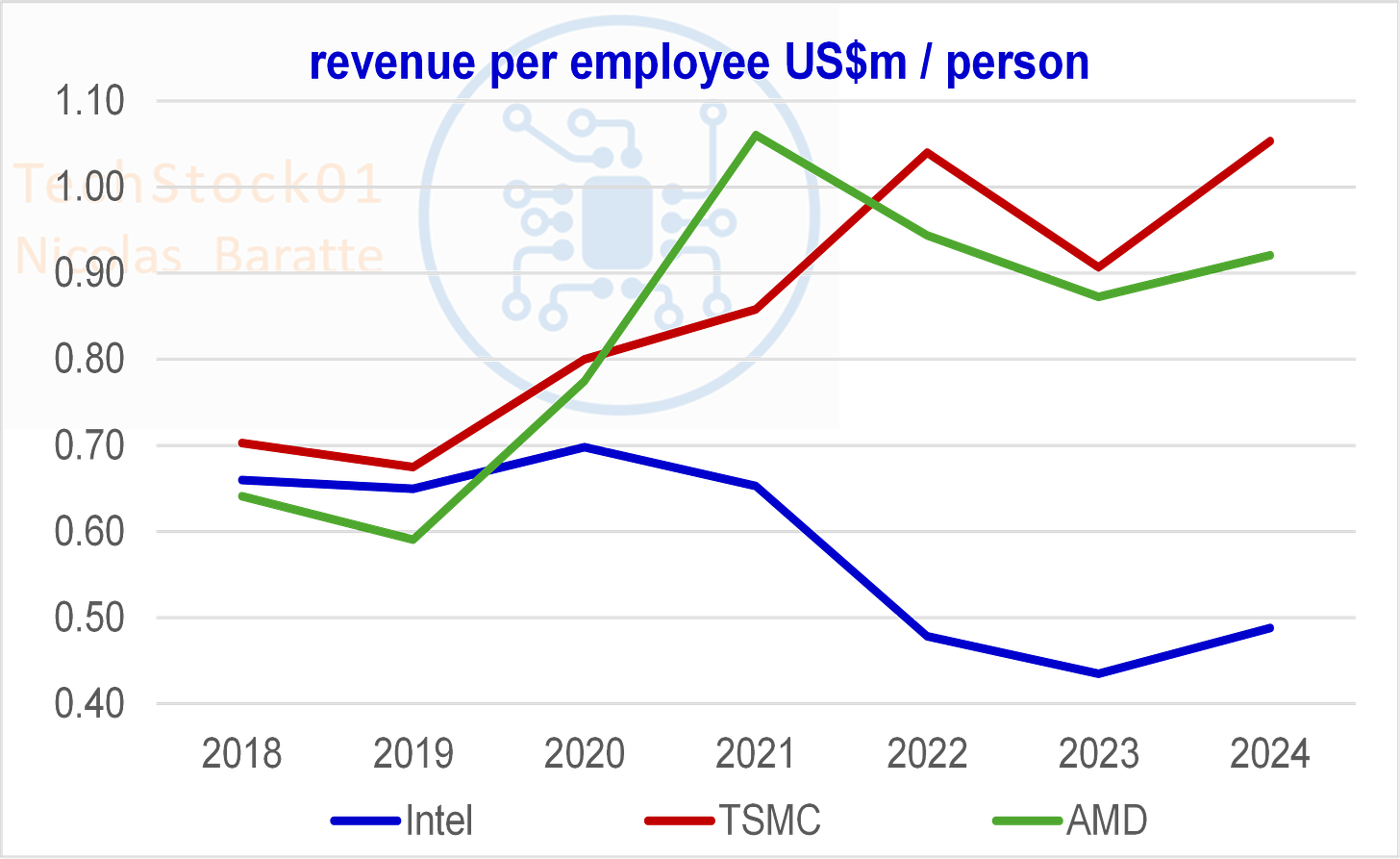

Intel layoffs started in May-June with office jobs, now extending to production in US, Israel. Intel’s revenue/employee is half that of AMD or TSMC. An AMD or TSMC employee generates 2x more revenue than an Intel employee.

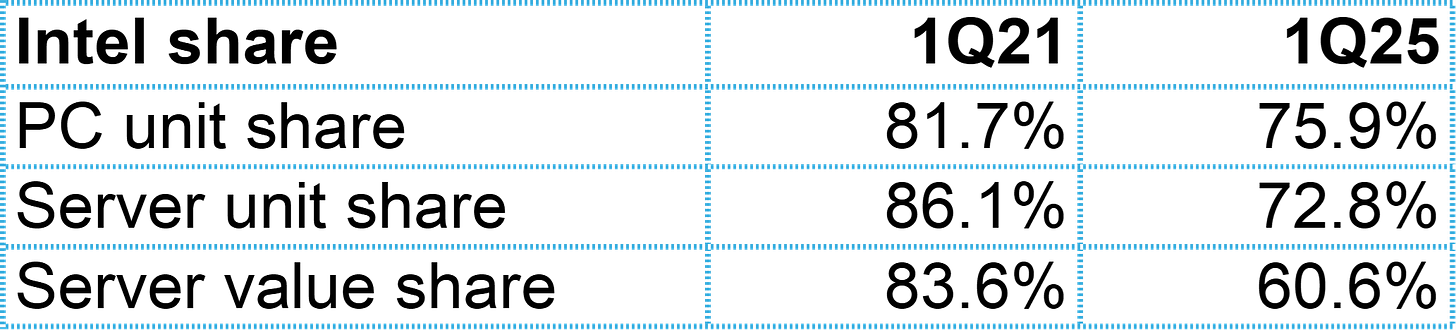

Intel share loss in PC and Server continues. Over the past 4 years (ie previous CEO) Intel lost 6 percentage points in PC market share (down to 76%), 13 percentage points in server (down to 73%).

Intel is now without an AI / GPU roadmap. It could look bad but the twist is that it helps Intel re-qualify with Nvidia DGX racks (for the server CPU in B300), replacing AMD. Weakness breeds strength.

An AMD or TSMC employee generates 2x more revenue than an Intel employee

In Dec 2020, Intel had 110k employees

Gelsinger arrives as CEO in Feb 2021, headcount increase by 10k to 121k end of 2021

One year later, another 10k employee added, total 132k

Headcount is up 20%.

And then, revenues shrink by -30% (2023 vs 2021), Gelsinger starts firing everybody he’s hired.

End 2024, Gelsinger is gone, headcount is back to 110k.

Gelsinger was supposedly Intel’s genius CTO in 2000-2010 but maybe not great in financial literacy? Revenue per head tells us that an Intel employee has half the productivity of an AMD or TSMC employee. 50%. Half. 0.5 versus 1.0 (that’s US$ million per employee).

New CEO LB Tan lands in March 2025. On 24 Apr 25, Tan tells his employees that massive slimming down is coming – he doesn’t say 20% headcount reduction, that’s the official leakage thru Bloomberg. Some office jobs were eliminated in May-June, Intel is now moving to shrinking factory / production jobs in Oregon, Israel, Ireland.

Intel Server and PC market share keeps declining

Last week during the AMD Advancing AI keynote, Lisa Su mentioned that AMD has reached 40% share in x86 Server. That’s value-share. AMD commands a bit less in units-share: 27%.

Just a quick glance at the past 4 years or from Gelsinger 1Q21 to Tan 1Q25. Intel has lost:

6 percentage points in computer units market share

13 percentage points in server units share

23 percentage points in server value share

Historical market share data below.

Intel without an AI solution ?

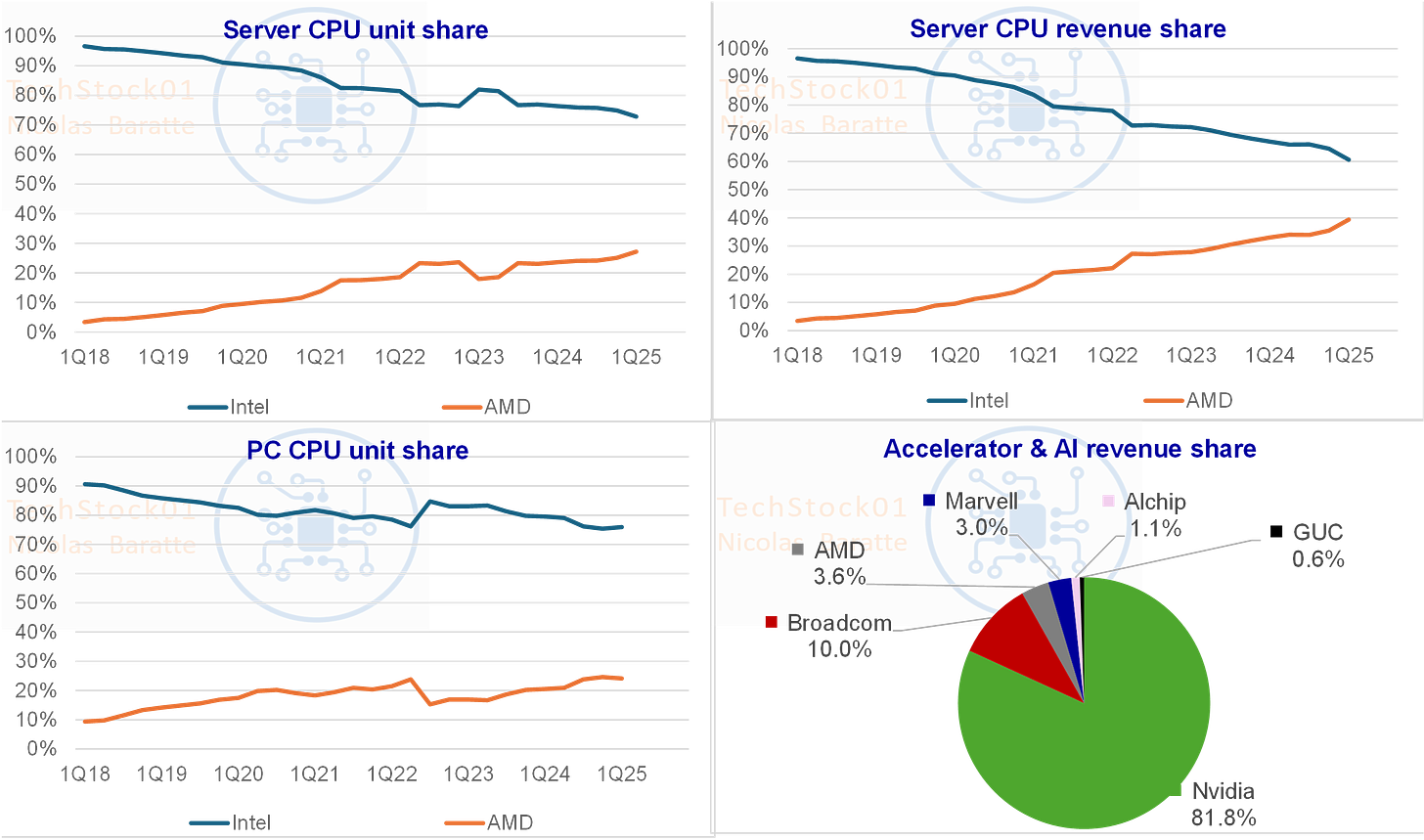

The pie chart above shows 2024 AI Accelerator or AI silicon revenue share. It’s becoming difficult to separate computing processor from networking in either Nvidia or Broadcom and we should look at total AI revenues in the data center. The point of this pie chart is that Intel isn’t there.

No more Gaudi

Gaudi 3 was expected to make a couple of $-billion revenue, then $500m, then Intel stopped talking about it. Last mention in Nov 2024 (3Q conf call): Intel CEO Pat Gelsinger admits that Gaudi 3 AI accelerator falls short of the $500 million revenue target for 2024.

No more GPU

Jan 2025, Product CEO Mrs Holthaus “many of you heard me temper expectations on Falcon Shores. based on industry feedback, we have decided to leverage Falcon Shores as an internal test chip without bringing it to market”.

I don’t know what leveraging internally is supposed to mean but Intel won’t have a GPU before 2027-28 (Jaguar Shores) – if ever. If Intel keeps investing in, developing Data Center GPU to compete with Nvidia and AMD, it is by now an elaborate waste of energy and money. By mid-26 AMD will have MI400 most likely on par with B300 on performance and ROCm not too far behind CUDA. If and when this happens, the Data Center market will have its 2nd solution provider and it won’t need a 3rd.

Failure can breed success

Unexpected twist! Intel is not competing with Nvidia any longer as Gaudi and Falcon Shores GPU are gone. AMD is a more potent threat to Nvidia, ie AMD really has a GPU (unlike Intel that claims to have one). Besides, AMD marketing doesn’t want to be associated with Nvidia (ie advertise that AMD server CPU are in Nvidia DGX GPU racks). We’re competitors, not partners.

So what happens next is Nvidia qualifies Intel server CPU Xeon 6 onto its Blackwell 300 boards (DGX)

https://newsroom.intel.com/artificial-intelligence/new-intel-xeon-6-cpus-maximize-gpu-ai-performance

That’s really cute. Intel was out – and now is back in. Failure breeds success. Involuntarily of course.