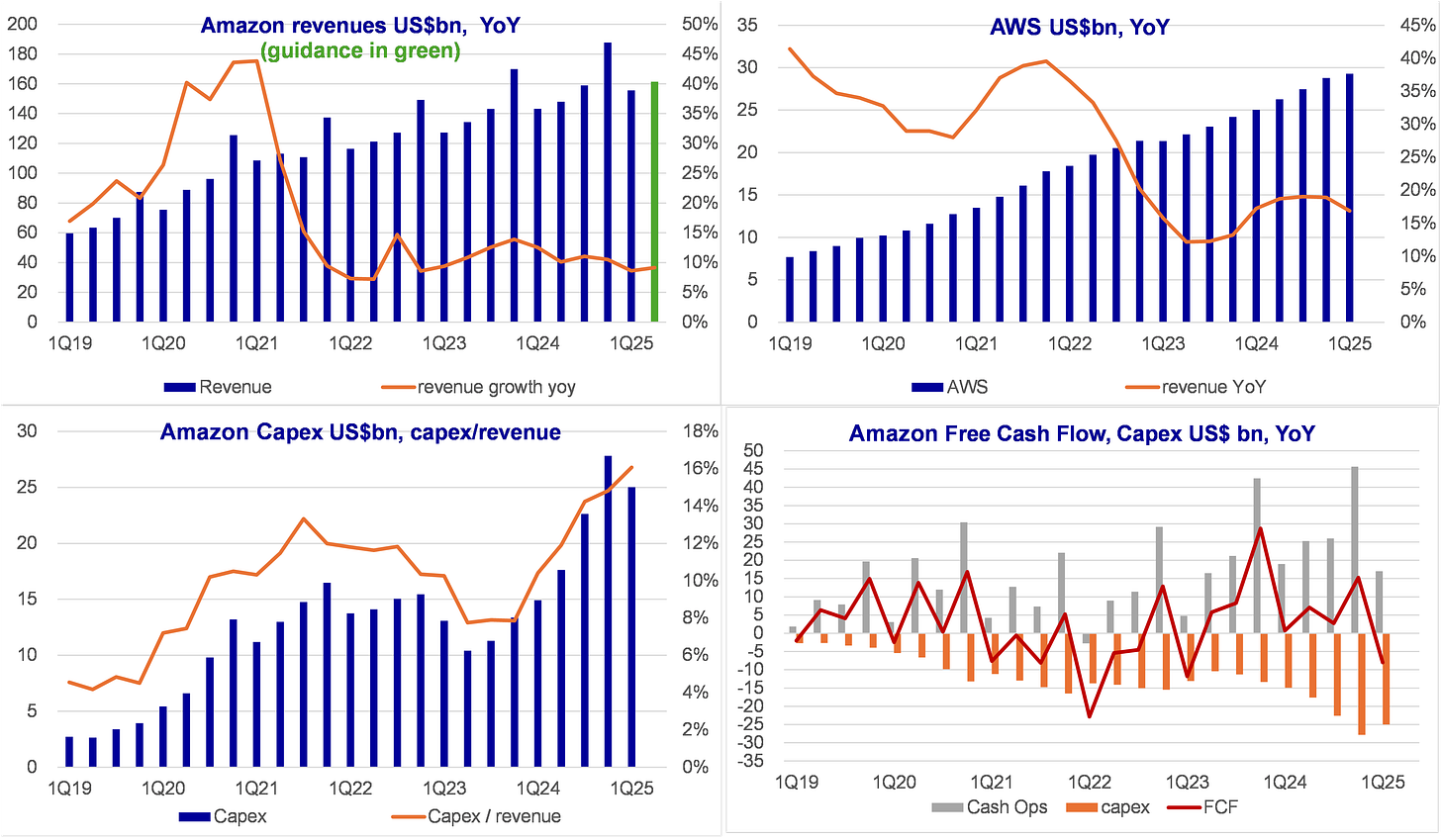

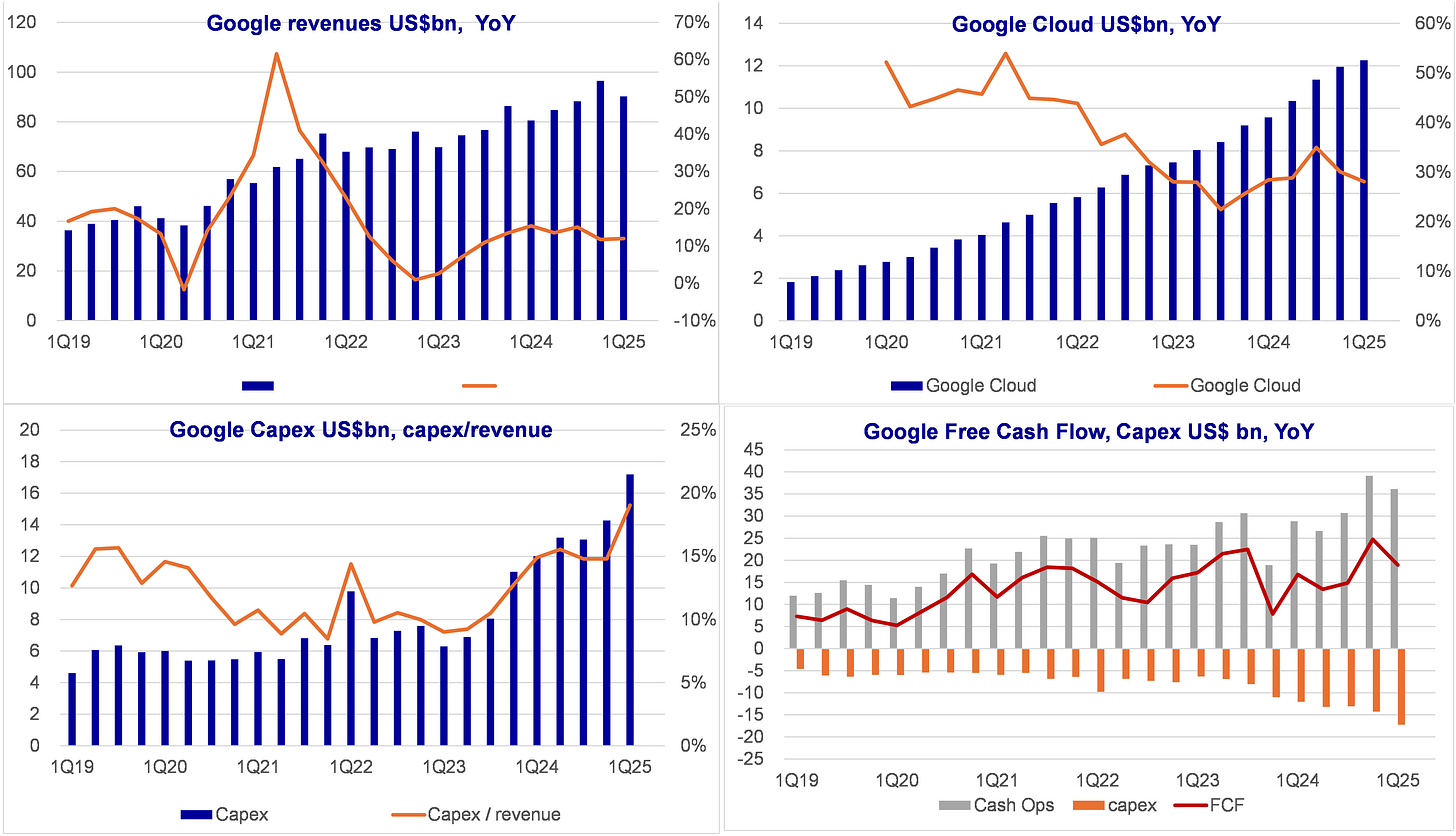

Hyperscale Capex is maintained or increased. No capex cuts or postponement. At the opposite: Amazon and Google are capacity constrained.

Positive to Nvidia and TSMC

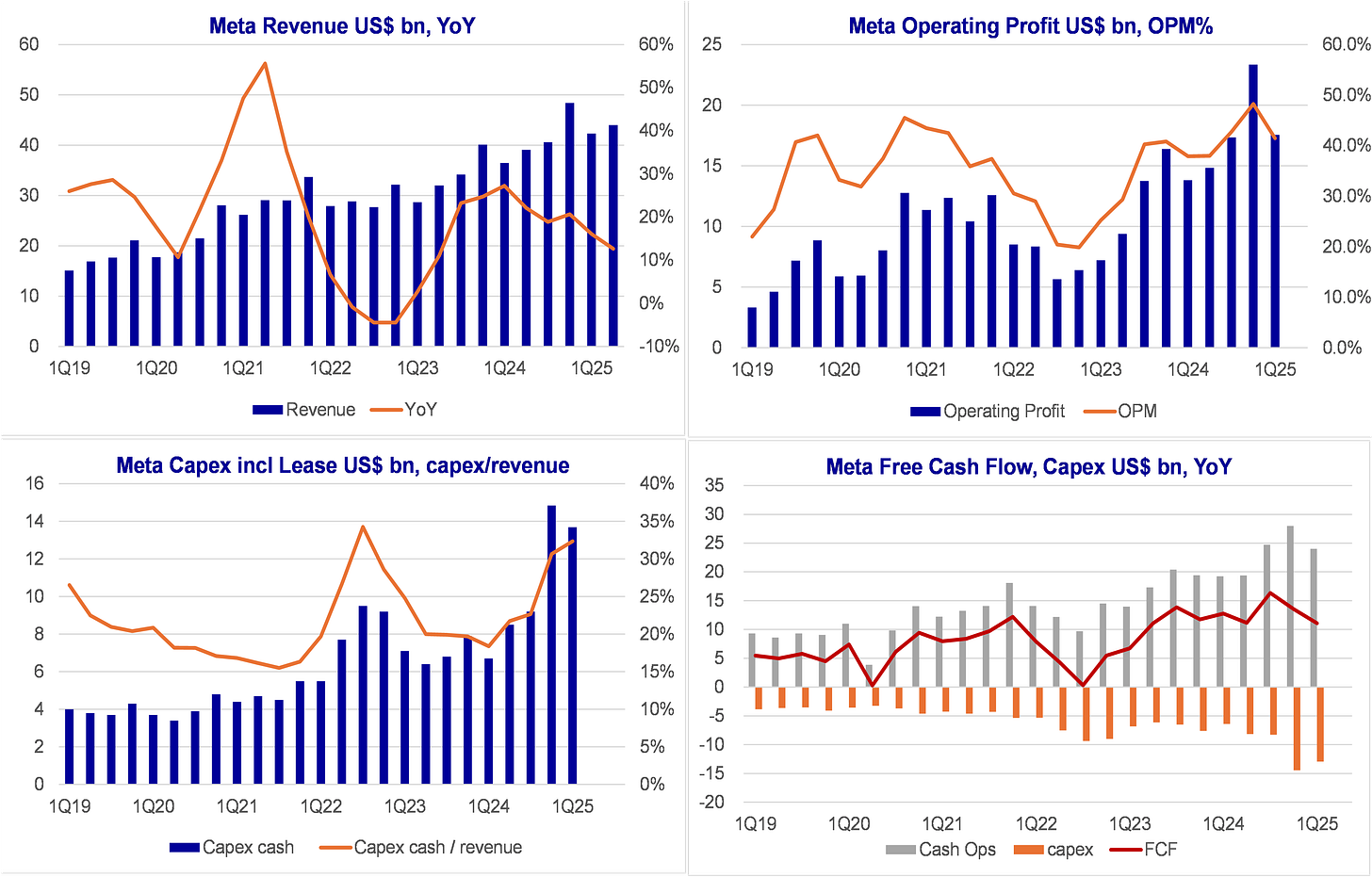

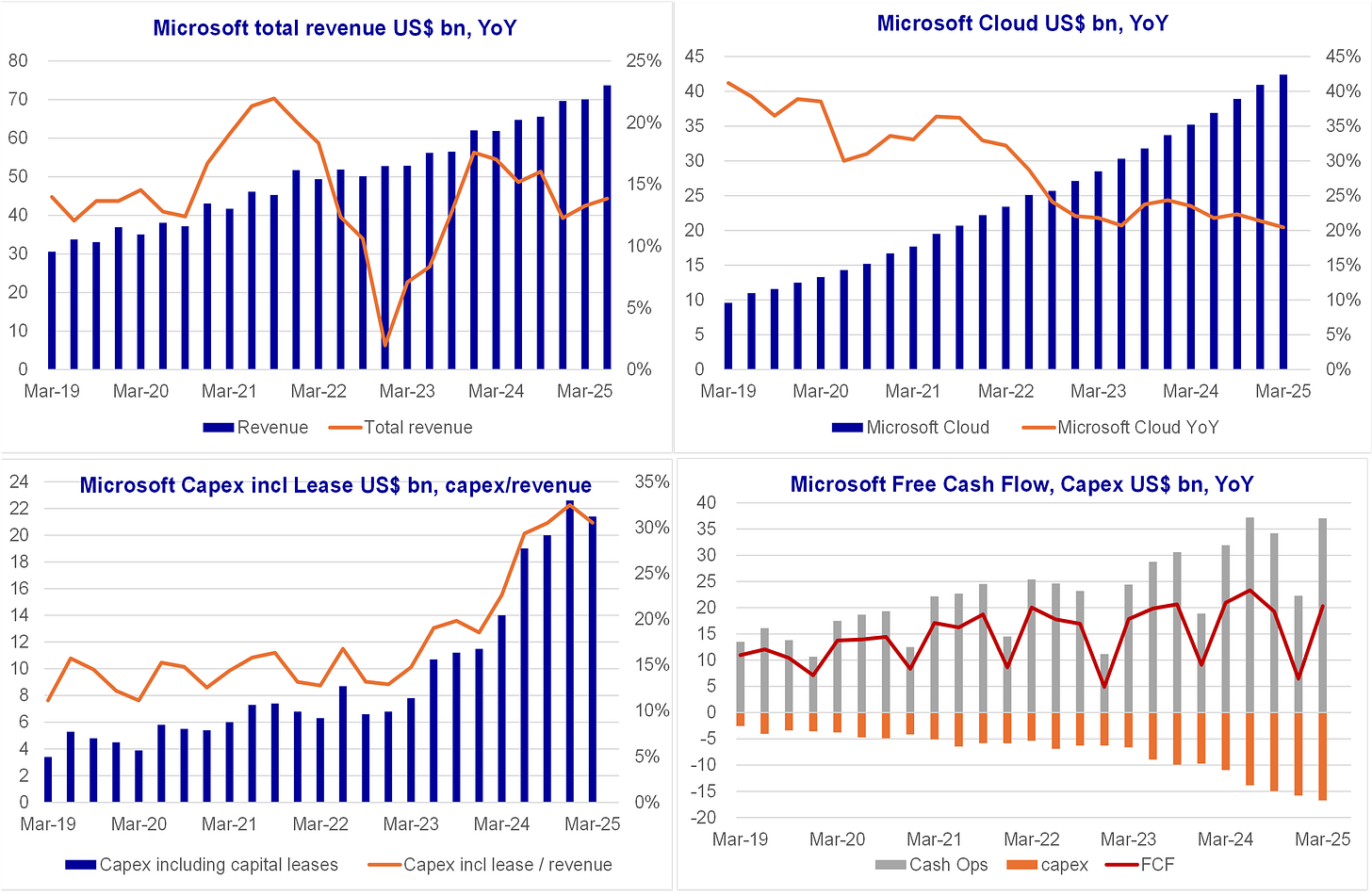

What did hyperscalers say on Capex in March conf calls? Amazon: nothing. Google: maintained. Meta: increase. Microsoft: maintained. No Capex cuts or postponement.

At the opposite, Amazon and Google mention capacity constraints, revenues could be higher with more capacity. All firms mention that AI is a critical building block of future growth.

Financial statements show 1) improving operating margins, 2) higher capex but still higher free cash flow. Positive for Nvidia and TSMC.

Short excerpts from conf calls on Capex and capacity

Amazon

I would tell you that our AI business right now is a multibillion-dollar annual run rate business that's growing triple-digit percentages year-over-year.

We have a lot more Trainium 2 instances and the next generation of NVIDIA's instances landing in the coming months.

AWS: 17% year-over-year growth on a $117 billion revenue run rate, still pretty significant growth. And as I said, I think we could be doing more if we had more capacity, and I expect that the capacity to ease in the coming months.

Now turning to our cash CapEx, which was $24.3 billion in Q1. The majority of this spend is to support the growing need for technology infrastructure. It primarily relates to AWS as we invest to support demand for our AI services and increasingly in custom silicon like Trainium as well as tech infrastructure.

Alphabet / Google

in cloud, we're in a tight demand supply environment and given that revenues are correlated with the timing of deployment of new capacity, we could see variability in cloud revenue growth rates depending on capacity deployment each quarter.

We expect relatively higher capacity deployment towards the end of 2025.

We still expect to invest approximately $75 billion in CapEx this year. The expected CapEx investment level may fluctuate from quarter-to-quarter due to the impact of changes in the timing of deliveries and construction schedules.

Meta Platforms / Facebook

We anticipate our full year 2025 capital expenditures, including finance leases, in the range of $64-72 billion, increased from our prior outlook of $60-65 billion.

Additional data center investments to support our artificial intelligence efforts as well as an increase in the expected cost of infrastructure hardware.

The majority of our capital expenditures in 2025 will continue to be directed to our core business.

Microsoft

Capital expenditures including finance leases were $21.4 billion, slightly lower than expected due to normal variability from the timing of delivery of data center leases.

Roughly half of our cloud and AI related spend was on long-lived assets that will support monetization over the next 15 years and beyond. The remaining cloud and AI spend was primarily for servers, both CPUs and GPUs, to serve customers based on demand signals including our customer contracted backlog of $315 billion.

We expect Q4 capital expenditures to increase on a sequential basis. H2 capex in total remains unchanged from our January H2 guidance. We expect quarterly spend in Q3 and Q4 to remain at similar levels as our Q2 spend

We continue to expand our datacenter capacity. This quarter alone, we opened DCs in 10 countries across four continents.

we've always been making adjustments to build, lease, what pace we build all through the last 10, 15 years, it's just that you all pay a lot more attention to what we do quarter-over-quarter nowadays

these are very long lead time decisions. From land to build, to build-outs can be lead times of five to seven years, two to three years

Looking at reported financials and Consensus forecasts, in aggregate below for the 4 hyperscalers

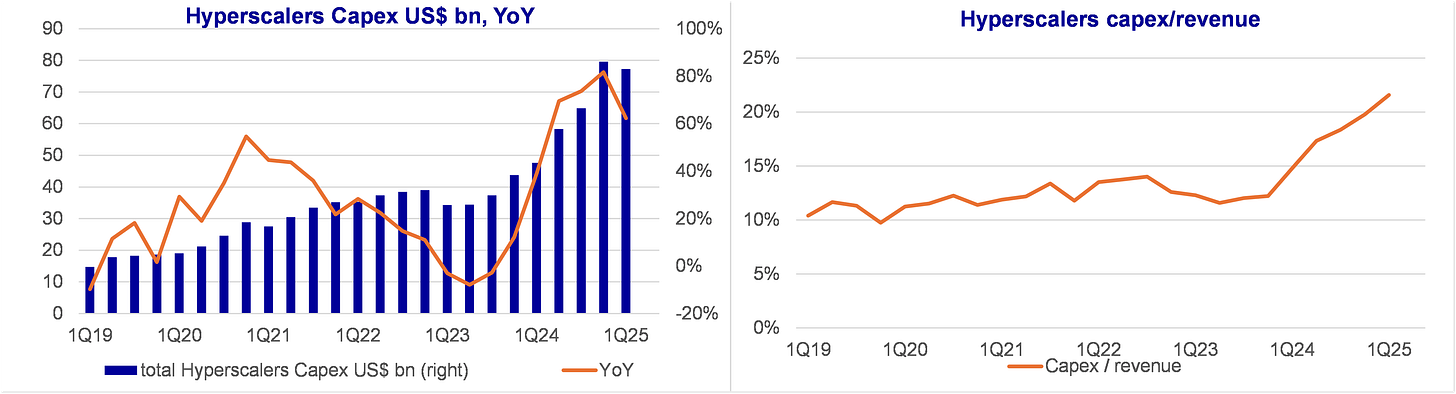

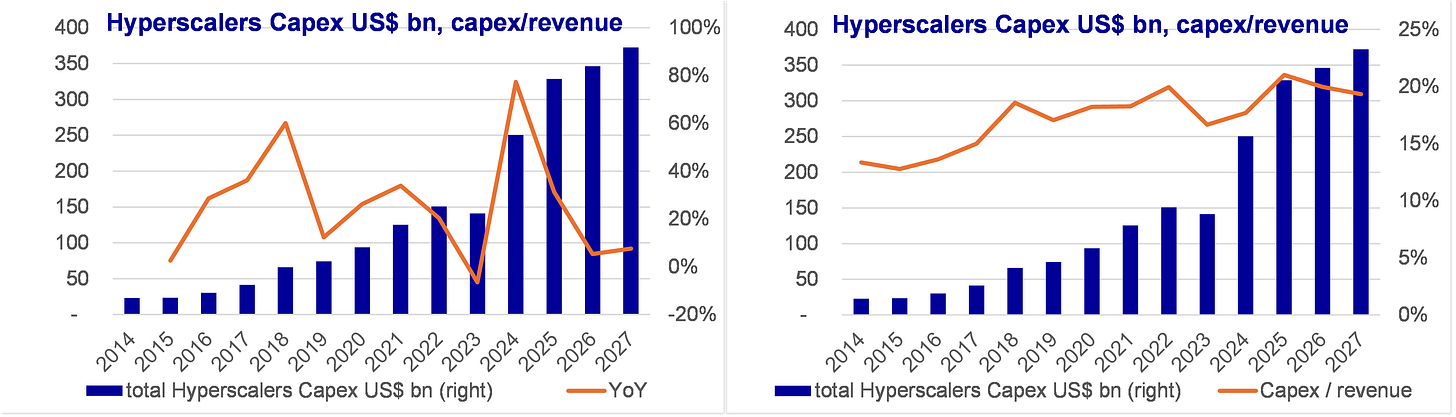

Capex growth is slowing down. It looks reasonable to think that capex/revenues has reached an unsustainable level and will decline – which means that capex growth will slow.

Consensus expects Capex growth to decline dramatically:

2024 +77% YoY

2025 +31%

2026 +5%

2027 +8%

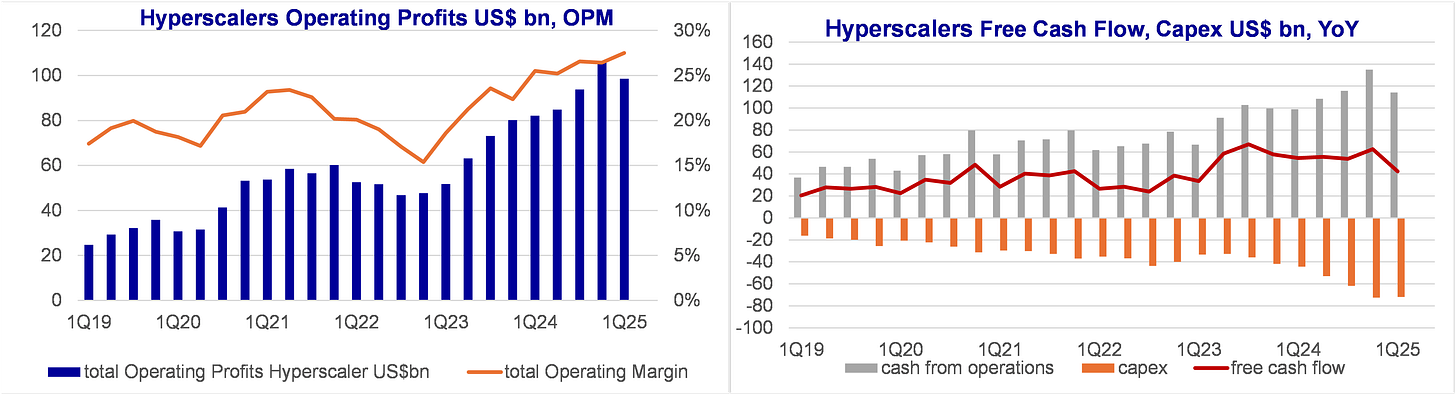

there is no sign of financial strain or negative impact from elevated Capex and AI investments. As such, we can understand why hyperscalers do not express concern that they could be over-spending:

operating profit and margins continue to increase (note below that 4Q is always a peak and the next 1Q shows a small decline QoQ)

free cash flows remain very positive – the increase in Capex has not lowered free cash flow

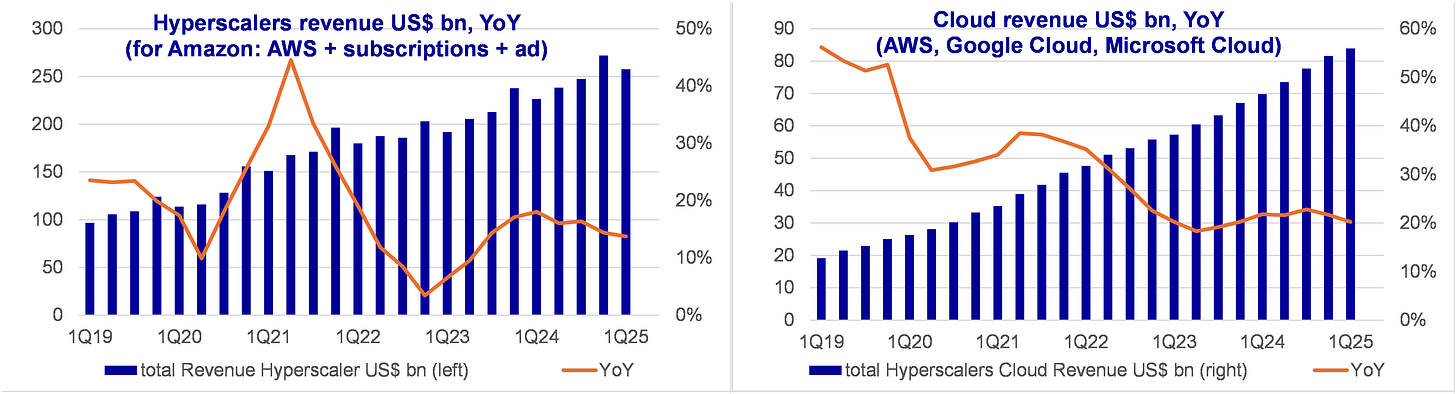

Revenue growth is not accelerating:

Total revenue growth slightly slowing down to 14% YoY

Cloud revenues steady growth at 20% YoY

What this means is:

Large Capex increase has not lead to higher revenue growth so far – or AI revenues are still a small fraction of total and we can’t see that boosting up total growth

But it has generated higher operating margins => AI improves margins – either more profitable applications, or lower cost, or more efficient utilization of the infrastructure.