Google: Ad and Cloud re-accelerating. Large impact of AI tools. Stock is not expensive.

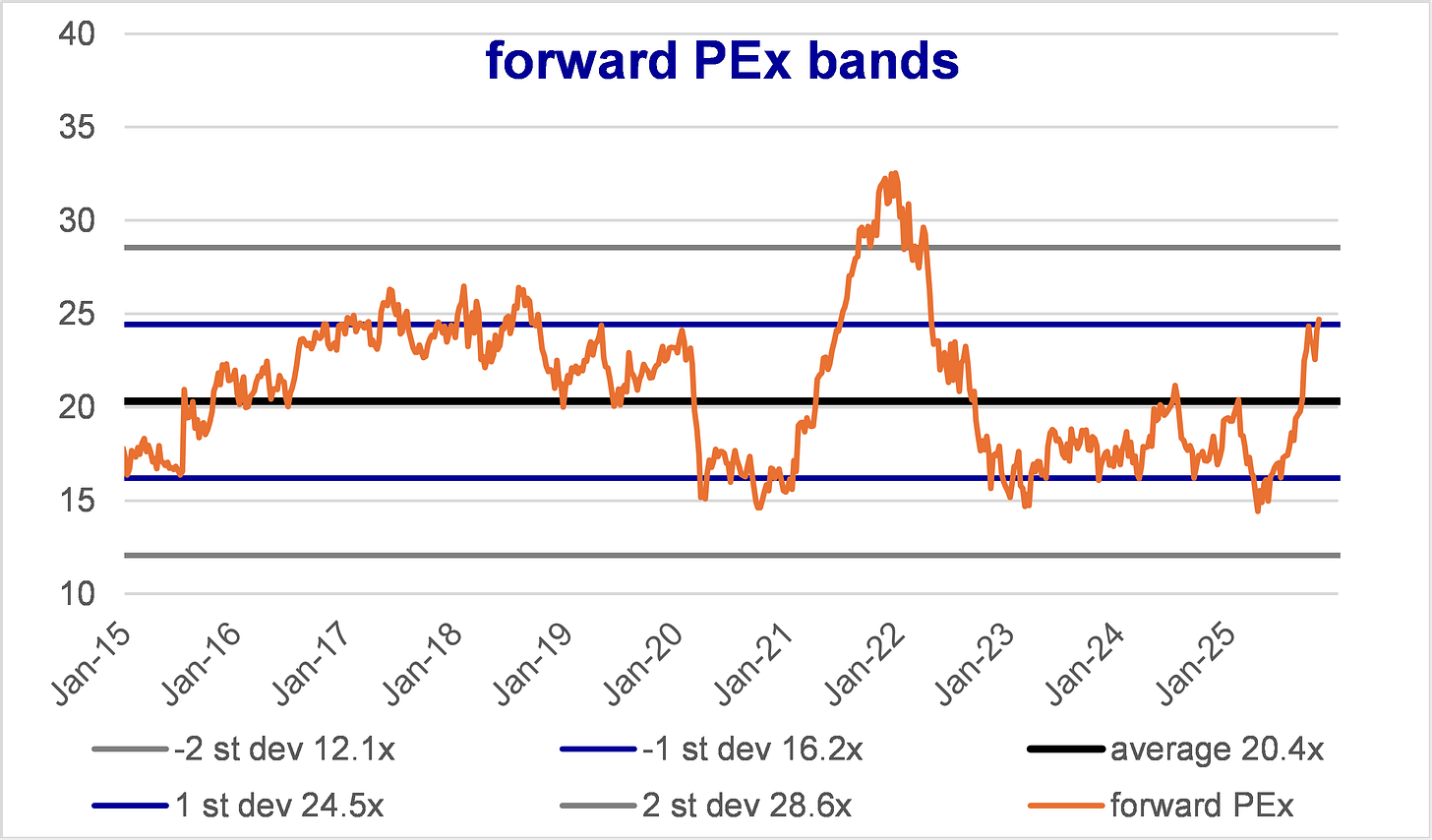

GOOG is trading at 25x 2026 EPS and 22x 2027. Not expensive.

Google was the laggard, the firm most threatened by ChatGPT and Search moving to AI Apps. A lot of ink was wasted predicting doomsday. Evidence of great management, Google stayed quiet and accelerated AI rollout.

Stellar 3Q25. Revenue up 16%, Operating Profit up 22%. 2025 Capex forecast was $75bn at the beginning of the year, now $92bn.

Consensus: not high. OP growth in 2026 15%, in 2027 13%. Beware low Net Income growth forecast for 2026 (6%) due to large non-ops investment gains in 2025. GOOG is trading at 25x 2026 EPS and 22x 2027. Not expensive.

Management’s quote you have to read:

“Our full stack approach to AI is delivering strong momentum and we’re shipping at speed, including the global rollout of AI Overviews and AI Mode in Search

our first party models, like Gemini, now process 7 billion tokens per minute

Gemini App now has over 650 million monthly active users.

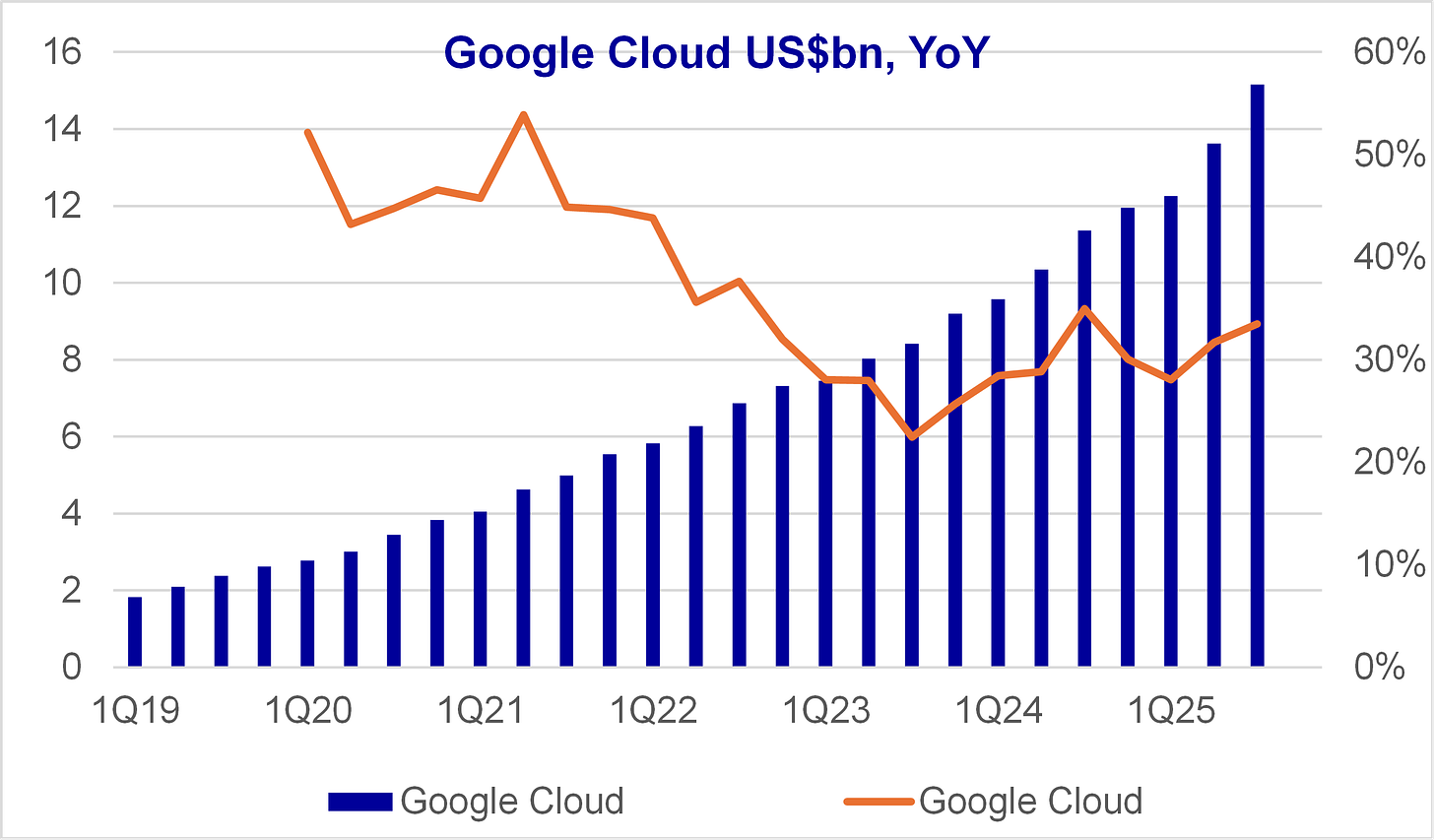

Google Cloud accelerated, ending the quarter with $155 billion in backlog

over 300 million paid subscriptions led by Google One and YouTube Premium.”

“highlights from search: AI is driving an expansionary moment for search

AI overviews drive meaningful query growth

last quarter, we rolled out AI mode globally across 40 languages in record time

Most importantly, AI mode is already driving incremental total query growth for search”

“Google Cloud: enterprise AI product portfolio is accelerating growth in revenue, operating margins, and backlog. we are signing new customers faster. The number of new GCP customers increased by nearly 34% year over year. we are signing larger deals. We have signed more deals over $1 billion this year than we did in the previous two years combined.

we see strong demand for enterprise AI infrastructure, including TPUs and GPUs, Enterprise AI solutions driven by Gemini 2.5, core infrastructure and other services such as cybersecurity and data analytics”

PAYWALL