AMD claims that its new GPU MI350-355 is on par with Nvidia, its software platform ROCm beats CUDA to run inference.

AMD stock is cheap, has bottomed out. Add to Nvidia and TSMC.

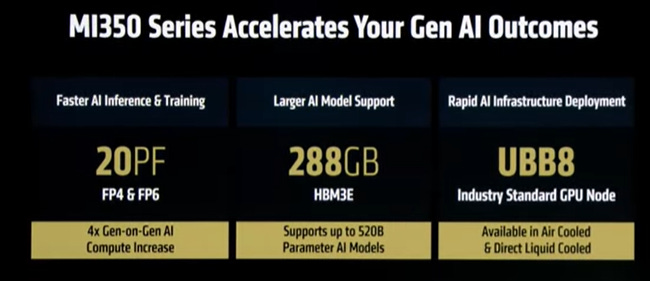

AMD launched MI300-355. AMD claims that for training, MI355 is on par with Nvidia’s B200. For inference MI355 generates more token per $, has a better TCO. MI350 shipped in May-25.

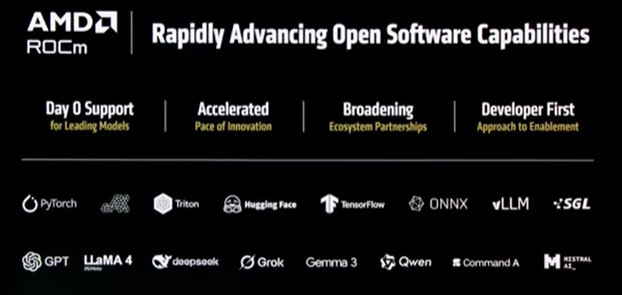

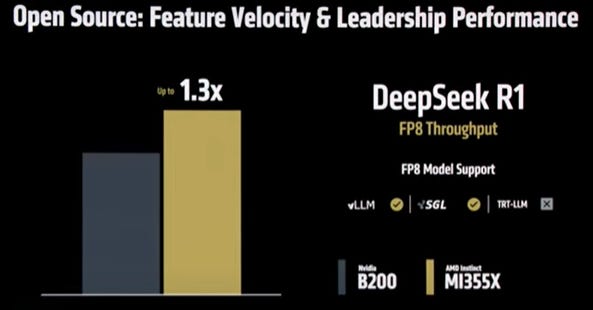

AMD updated its open-source programing development platform, ROCm7 which beats CUDA / B200 running inference (DeepSeek). AMD taking shots at Nvidia’s CUDA: “closed” and “proprietary”.

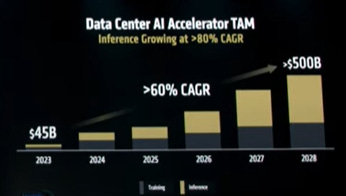

AI addressable market: AMD maintains its $500bn by 2028 estimate, 60% Cagr “or exceeding that”. Inference will grow faster, over 80% Cagr.

Distinguished guests all lined up: xAi, Meta, OCI, Astera Labs, OpenAI Mr. Altman himself. Microsoft and Cohere stressed that AMD MI350 TCO is great – I suppose implying better than B200. Red Hat talks open LLM and distributed LLMd thru Kubernetes ~ cool.

AMD stock is cheap, has bottomed out, AMD's event yesterday has cleared the many doubts over the competitiveness of its GPU roadmap versus Nvidia. For investors looking for an alternative to Nvidia and TSMC, AMD is the best alternative imo.

AMD held its annual Advancing AI conf yesterday

This report is a summary of the 2 hours event. Consensus forecasts and valuations of the stock at the end.

Lisa Su sees an AI diffusion roadmap similar to Jensen Huang’s:

LLM was a stepping stone

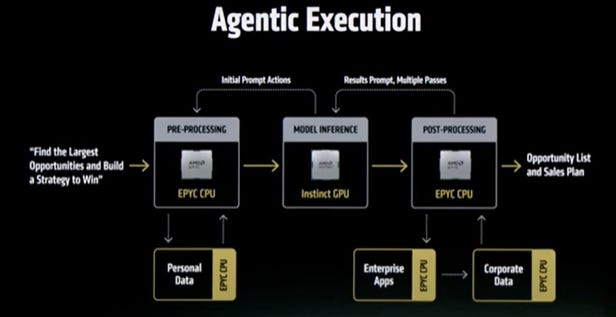

Agentic / AI Agents is next for task automation (like my job)

Followed by purpose-built models (healthcare, finance, manufacturing)

Deployed in the data center and beyond: edge, client

AI processor addressable market

Last year AMD estimated AI silicon TAM at $500bn in 2028, 60% CAGR

This year AMD estimate: AI TAM will exceed $500bn in 2028

Inference will grow faster with 80% Cagr

Of all solutions (ie compared to ASICs), GPU will have the largest market share, because users need flexibility and programmability.

Users also need a range of solutions, the right amount of compute for the right model, for a specific use-case for cloud / edge / client deployments.

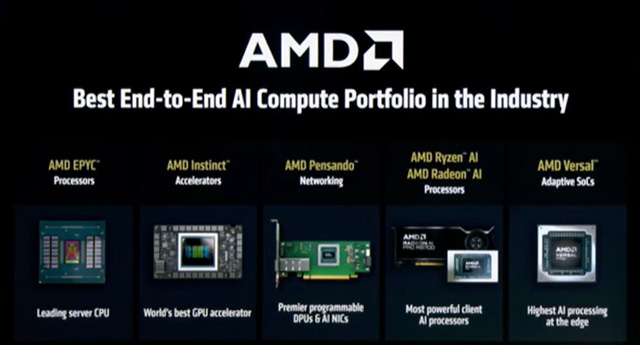

AMD has the most complete suite of computing elements: CPU, GPU, DPU, NIC, FPGA

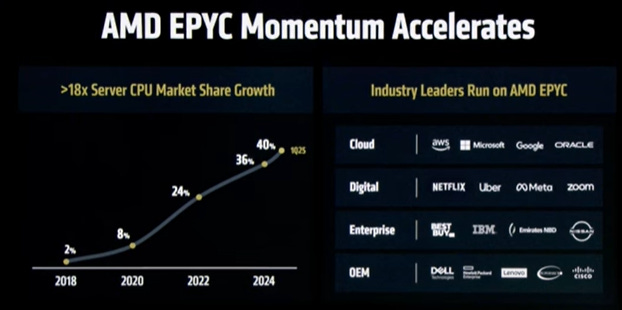

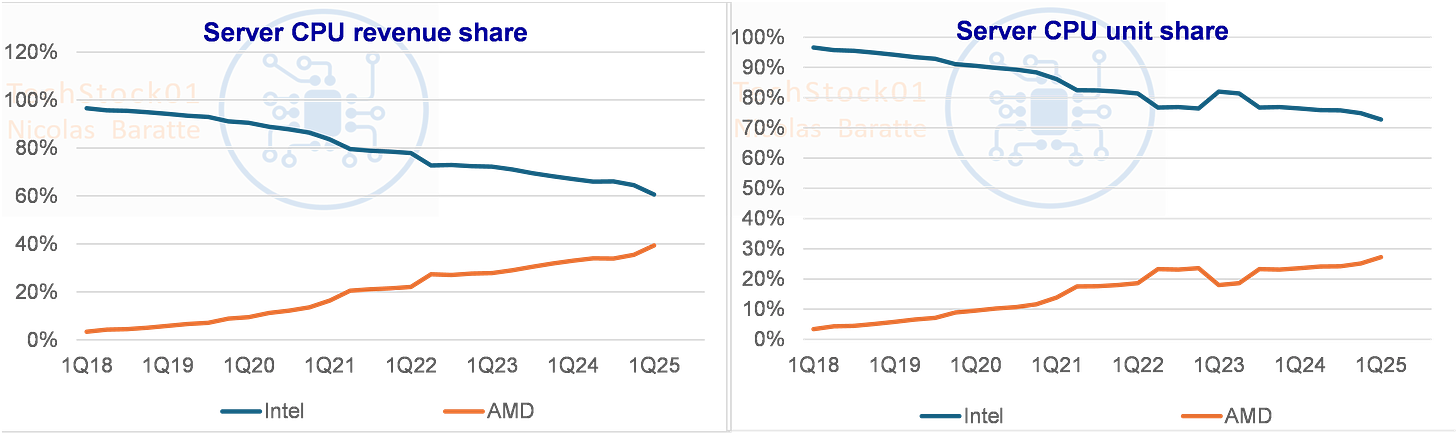

Data Center CPU: AMD has 40% market share

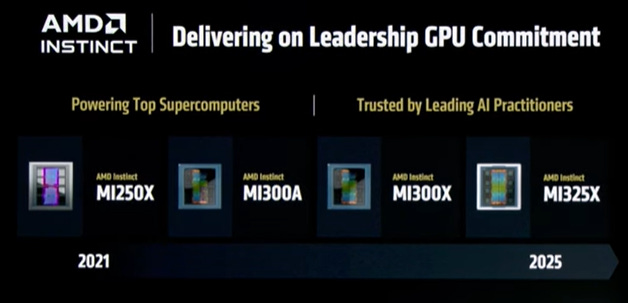

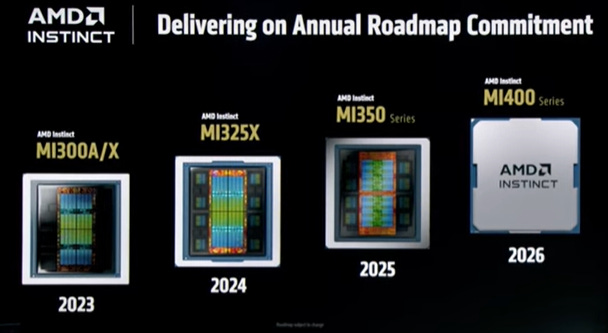

Data Center GPU: annual cadence of new chip launch (same as Nvidia more or less)

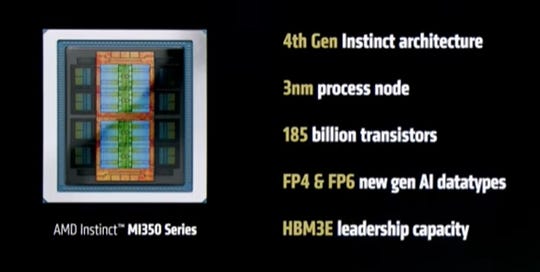

MI350 and 355 (higher thermal) launch announcement

Data Center GPU: the new MI350-355 is a big step forward forward to catch up to Nvidia.

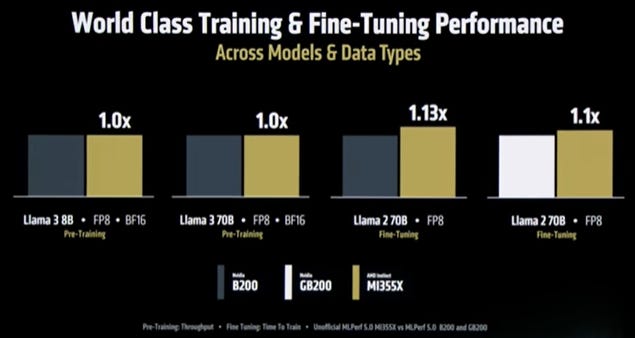

MI355 can outperform B200 for specific workloads – even though Nvidia has a proprietary stack.

For inference, MI355 generates more token per $, has a better TCO

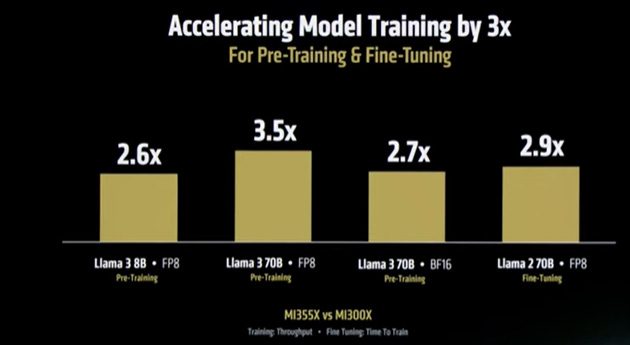

For training, MI355 is 3x better than MI300

And MI355 is on par with B200

software development platform ROCm

AMD software development platform ROCm is open software, which is critical to rapid development, ie Linux, Android. AMD is taking shots at Nvidia’s “closed” and “proprietary” software.

Partners, lots of partners, and developers.

AMD launched its Developer Cloud: GPU available on demand, with free credits.

And tools for developers

Next iteration of ROCm: ROCm7 announced today

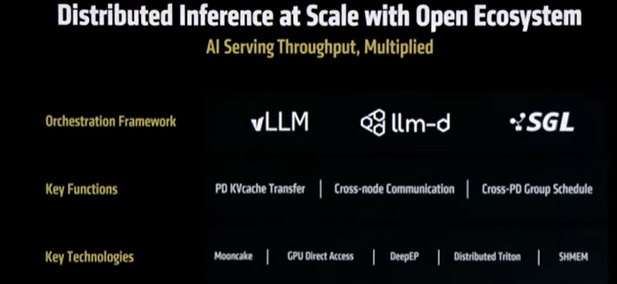

Distributed inference

Large scale training

Easy deployment, scaling up

Easy integration with kernels, etc

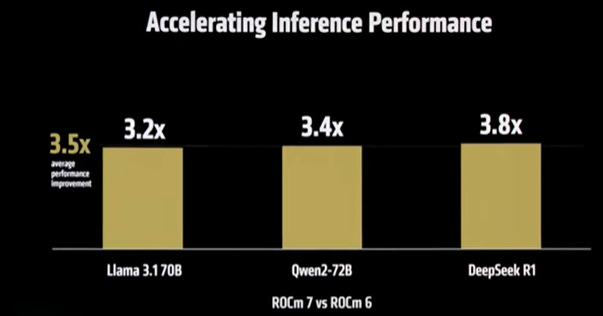

ROCm7 performance is a 3.5x improvement on ROCm6

And beats Nvidia’s B200 to run inference, example: DeepSeek

If you care about Agents, at 1h30 mins of the keynote is an interesting overview of the process / architecture.

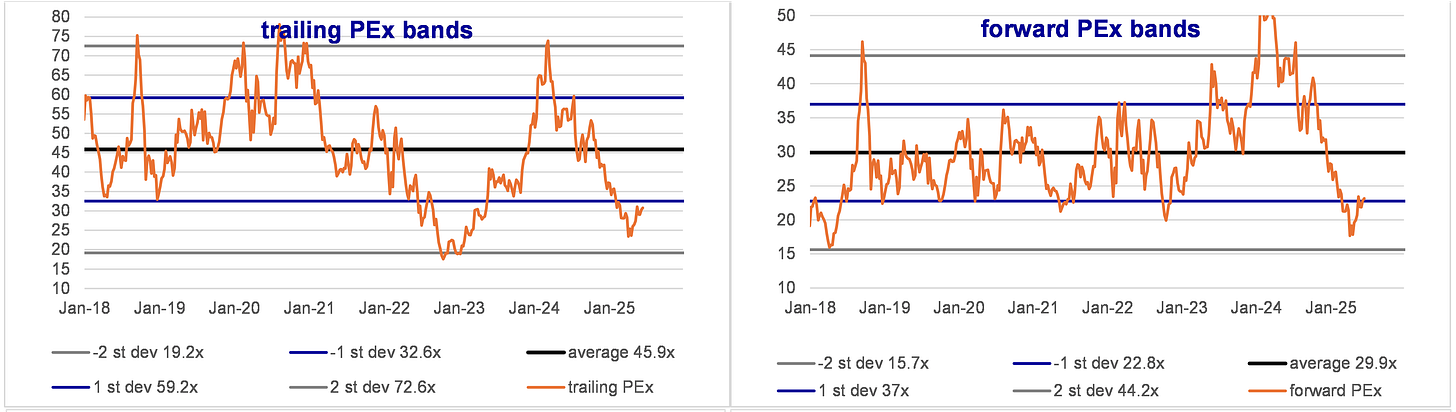

Consensus forecasts, valuations

AMD stock is cheap, has bottomed out, the roadmap is more competitive, etc. for investors looking for an alternative to Nvidia and TSMC, AMD is the best alternative imo.

In 2024, AMD total revenues are split almost equally between:

Data Center $12.5b, including:

x86 server CPU $7.5bn

GPU $5bn

All the rest, Computer, Gaming, etc $13bn

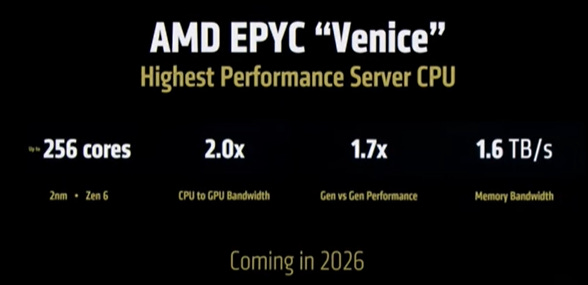

In Data center x86 CPU, AMD is steadily gaining share away from Intel and 2026 is already done – Intel doesn’t have products to regain market share. With its 2026 server CPU “Venice”, AMD is talking about reaching 50% value-share. I guess so.

In Data center GPU, we can use the TAM growth provided by AMD and benchmark 70% growth in 2025 (TSMC says double) and 50% in 2026, 40% in 2027.

Let’s assume that “all the rest” is a bunch of legacy stuff that’s ex-growth.

This brings us close to Consensus revenue forecasts.