AMD Analyst Conf: 4 things to know.

Buy more.

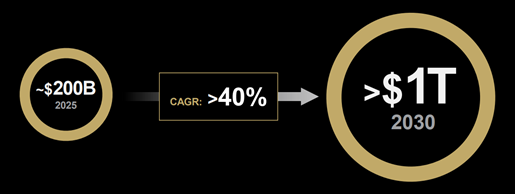

AMD is revising up its AI TAM, again. In Dec ’23 AMD said $400bn by 2027. In Oct ’24 $500bn by 2028. Now it’s $1tn by 2030. That’s 40% CAGR for the TAM and 60% CAGR for AMD total Data Center revenues incl Server CPU, NIC, NPU, etc.

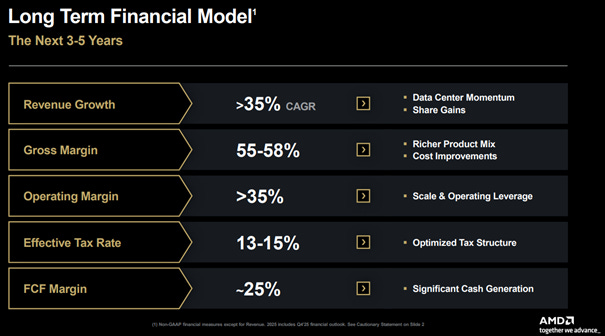

AMD is usually shy on guidance but not today. AMD provided a 3-5 years outlook that points to ~40% Net Income CAGRr to 2029-30. If we assume some derating (the stock is now trading at an unsustainable 50x), Market Cap will grow at ~20% CAGR. This implies that your share price will 2.1x to ’29 and 2.5x to ’30.

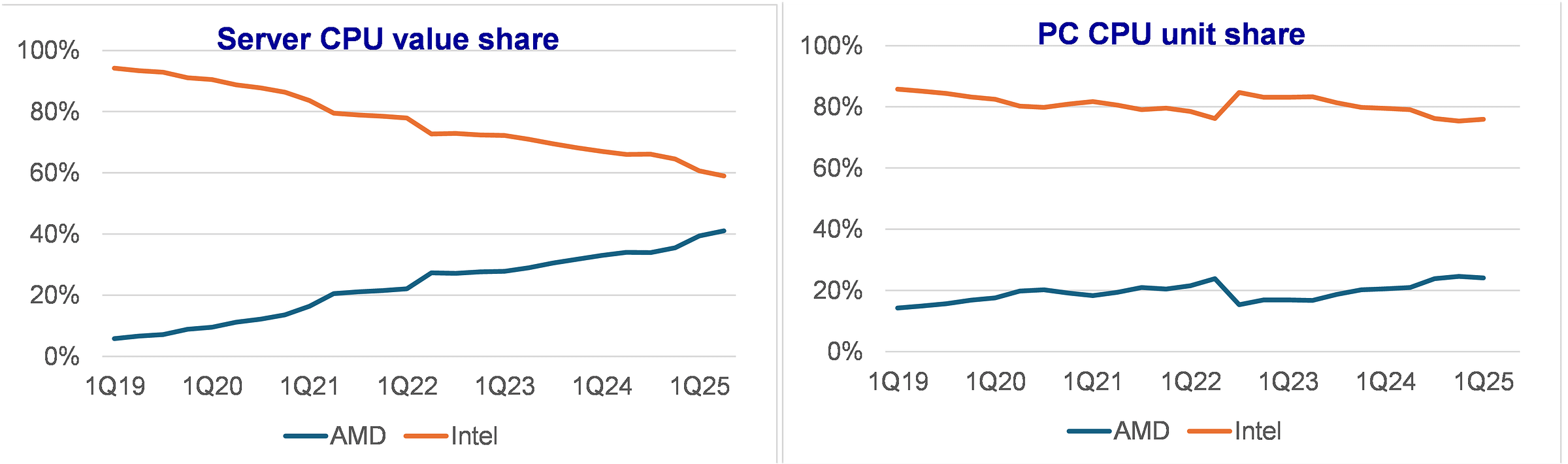

If AMD is correct on its market share gains, Intel is in trouble. AMD says it will reach 50% Server CPU value share (3-5 years out), AMD is now at 40%. AMD targets 40% PC CPU share, AMD is now at 25%. Remember that PC is the cash cow for Intel (30% OPM).

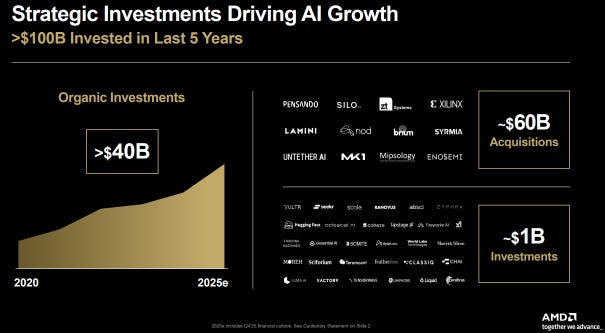

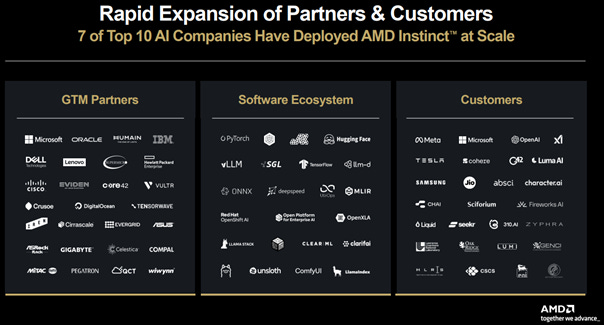

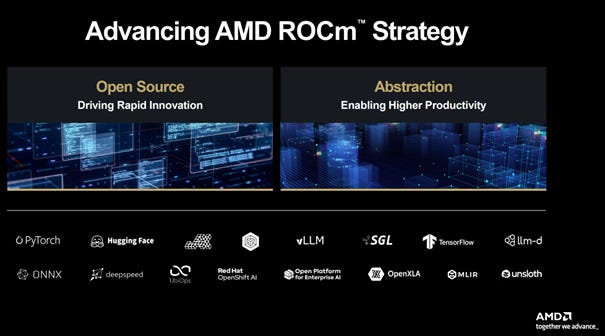

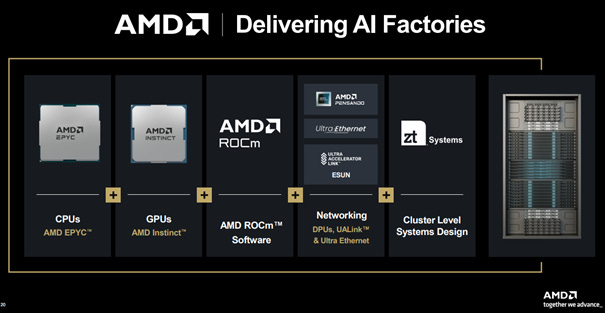

How to compete against Nvidia in Data Center Accelerators? IMO, AMD gets it – whereas Intel still doesn’t get it. It is not do everything yourself. It is an open source development platform, tons of software alliances, different levels of board-to-rack integration.

All the slides are available here: https://ir.amd.com/news-events/financial-analyst-day

Total Addressable Market TAM revised up, once again

AMD annual event, either “Advancing AI” or today’s Analyst Day.

Dec ‘23 AMD estimated its Data Center Total Addressable Market to $400bn by 2027

Oct ’24 revised up to $500bn by 2028

Nov ’25 revised up to $1 trillion by 2030

This was Oct ’24

And today:

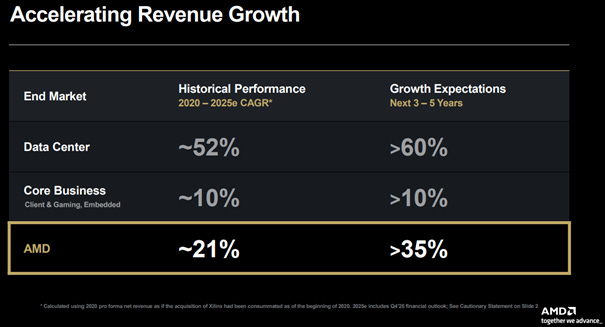

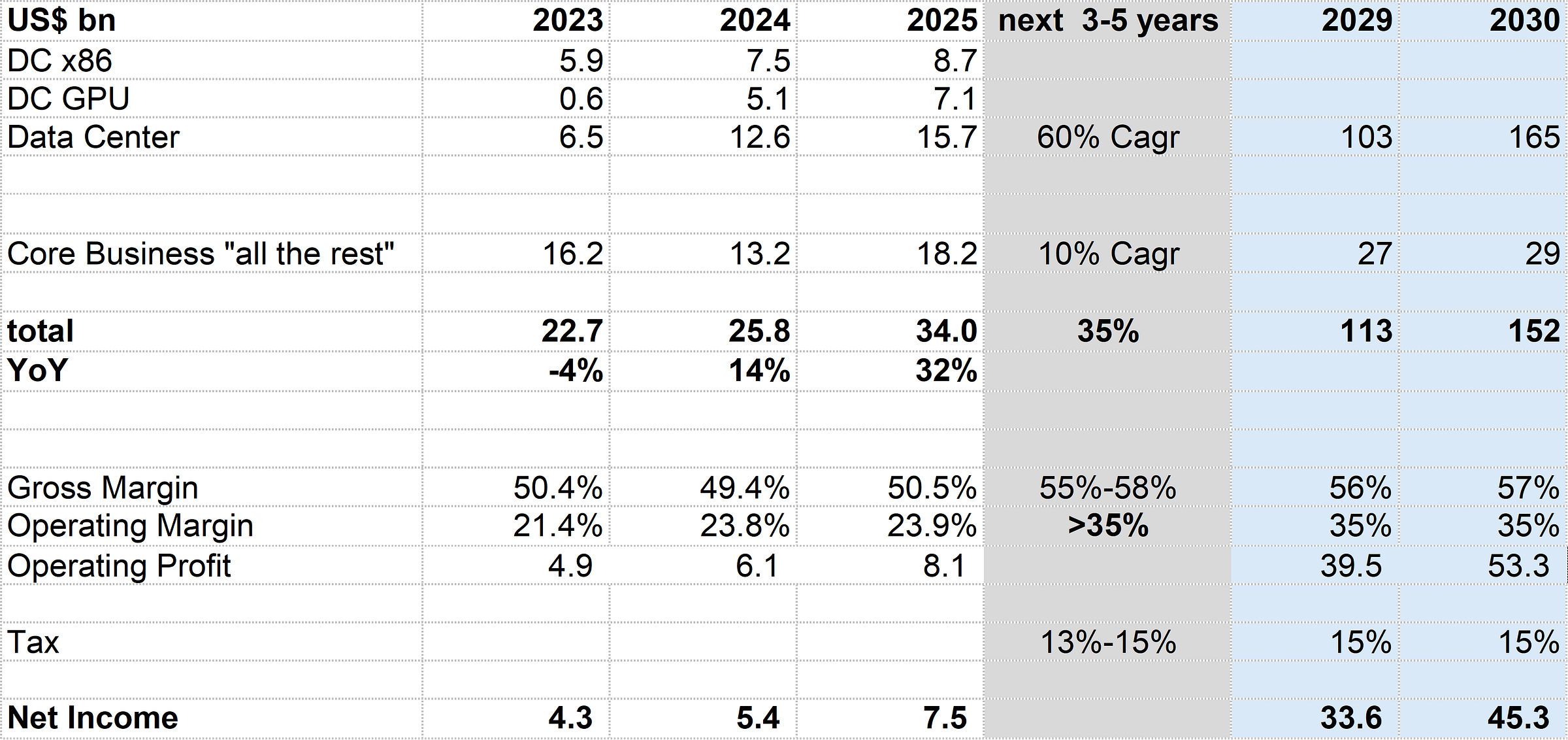

AMD 3-5 years forecasts: ~40% Net Income growth

AMD released very big numbers on all metrics:

This slide below refers to total Data Center revenues, including Server CPU: >60% CAGR.

There is another slide that probably refers to Accelerators only (GPU, DPU) and growth is higher: >80% CAGR. So we have a range of numbers:

Traditional revenues (PC, Gaming) >10% CAGR

Total Data Center revenues, including Server CPU >60% CAGR

Accelerators only (GPU, DPU) >80% CAGR

Total revenue >35% CAGR

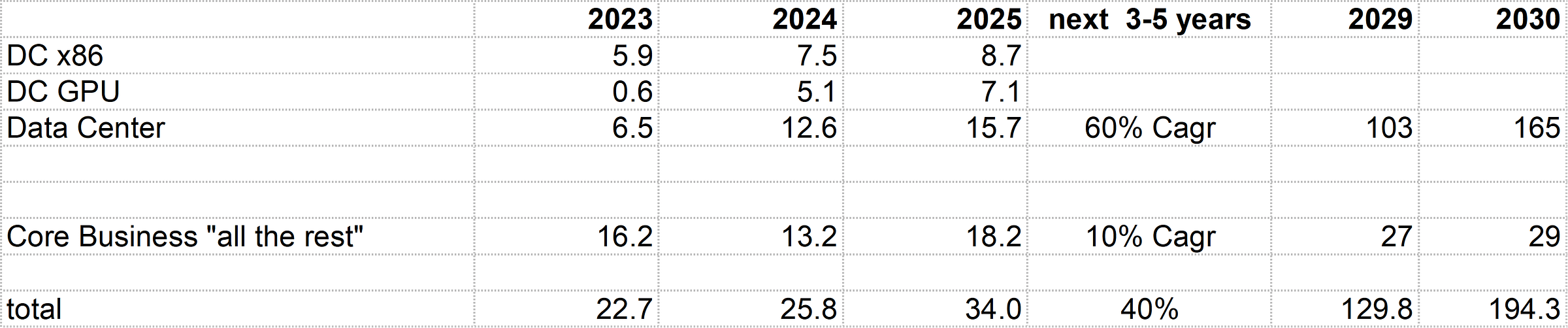

Little bug: if you plug in 60% CAGR for Data Center and 10% CAGR for “all the rest”, you do not derive 35% CAGR for total revenue. You derive a higher number ~40% CAGR. Never mind. AMD is not going to explain how they calculated these numbers and if some stuff is excluded / reclassified.

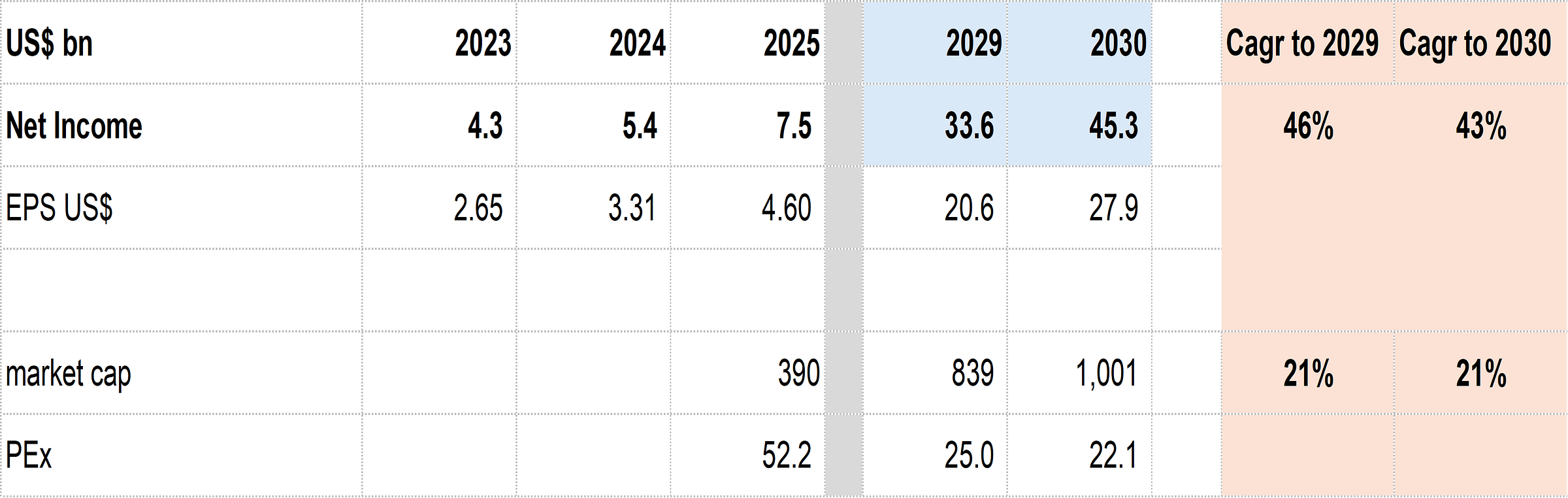

If we take AMD’s numbers literally, and let’s say apply to 4 years out (2029) or 5 years out (2030), we get this: Net Income Cagr over 40% in 2029 and 2030.

Next, we need a Net Income multiple (like a PEx that assumes some future dilution like OpenAI shares) and of course:

1) The multiple will normalize. AMD is now trading at 50x 2025 net income and that’s very high, i.e. it assumes high future growth. The stock will derate.

2) What’s a normalized multiple? I think 20x to 25x is the range, the “boring” range for a steady growth Semi company

What we get is:

Net Income CAGR ~40%

Market Cap (share price) CAGR ~20%

I had some fun with the PE multiple in this table to get to the magic $1 trillion market cap.

If you want to derive EPS, based on today’s number of shares, you get to US$ 21-28 per share, which is indeed consistent with AMD’s guidance of >$20.

AMD continuous market share gains in the x86 markets, both PC and Server

Here is a graphic illustration of what I would call the brilliant Lisa Su management versus the Gelsinger’s failure. Seriously, losing 35 percentage points of Server value share in 5 years take some determination. In PC, AMD share gains have been more modest, partially because Intel has good products, partially because resource-constrained AMD has put its R&D money on Data Center.

AMD understands the ecosystem approach to Data Center

This spans multiple dimensions:

Acquisitions for what you don’t have: software, networking, some accelerators, integration

Huge effort on software compatibility, portability and open sourcing the development platform. If you are the market leader (Nvidia), you can force compatibility to your closed platform (CUDA). If you’re a late comer, you can’t do that: you have nothing attractive to offer.

You don’t need 1 chip, you need the range of CPU, GPU and other accelerators (FPGA, DPU), the interconnect, the rack integration, the data center level integration… it takes a lot more than claiming good TOPS on a single chip.

That 40% net income CAGR projection through 2030 is agressive but Lisa Su has earned the benefit of the doubt with execution. The ecosystem approach you highlighted is exactly what seperates them from Intel right now. Their open source strategy and board to rack integration shows they understand you cant just win on chip performace alone anymore. Gaining 10 points of server share while Intel bleeds is telling.